No, Uniswap is also available on Polygon, Arbitrum, and Optimism, besides Ethereum.

Overview of Uniswap

What is Uniswap?

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly from their wallets without the need for an intermediary. It operates on the Ethereum blockchain and uses smart contracts to facilitate automated transactions between token pairs.

- Decentralized Finance (DeFi): Uniswap is a key player in the DeFi ecosystem, providing liquidity and enabling decentralized trading.

- Automated Market Maker (AMM): Uniswap employs an AMM model, which means that trades are executed against a liquidity pool rather than a traditional order book.

How Does Uniswap Work?

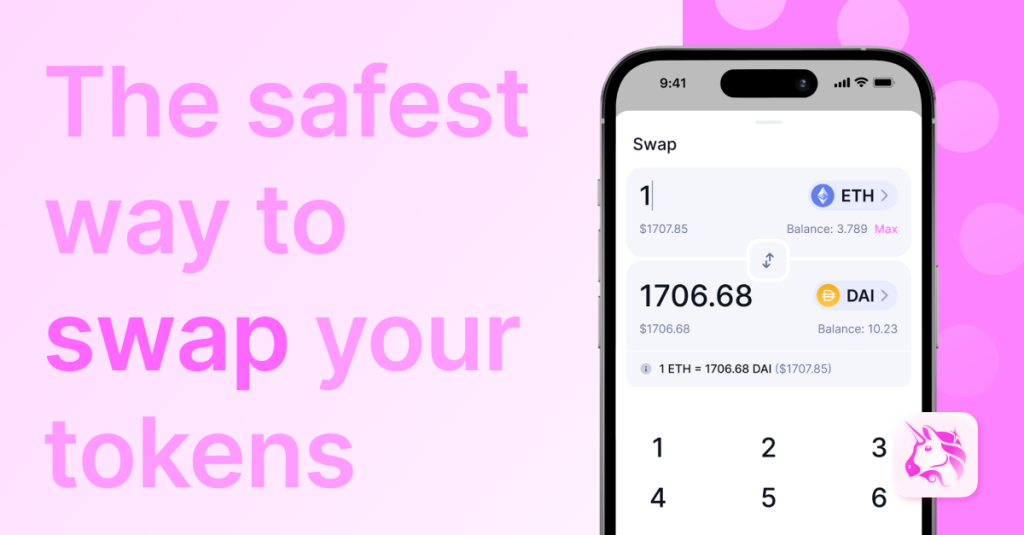

Uniswap uses a unique protocol to facilitate token swaps, relying on liquidity pools and smart contracts to ensure seamless and automated trading.

- Liquidity Pools: Users can provide liquidity to Uniswap by depositing pairs of tokens into pools. These pools provide the funds needed for trades and, in return, liquidity providers earn a share of the trading fees.

- Token Swaps: When a user wants to trade one token for another, Uniswap’s smart contracts calculate the exchange rate based on the pool’s liquidity and execute the trade automatically.

- Fees: Uniswap charges a small fee for each trade, which is distributed to the liquidity providers as an incentive for supplying the liquidity.

Supported Blockchains

Uniswap on Ethereum

Uniswap originally launched on the Ethereum blockchain, leveraging its robust infrastructure and smart contract capabilities. Ethereum remains the primary and most popular platform for Uniswap due to several key factors.

- Smart Contract Functionality: Ethereum’s well-established smart contract framework allows Uniswap to execute automated and secure transactions efficiently.

- Liquidity and Volume: As the first platform Uniswap was built on, Ethereum has the highest liquidity and trading volume, making it the most active and vibrant market for Uniswap.

- Ecosystem Integration: Uniswap is deeply integrated into the Ethereum ecosystem, including various DeFi projects, wallets, and decentralized applications (dApps).

Uniswap on Other Blockchains

While Uniswap started on Ethereum, it has expanded to other blockchains to offer users more flexibility and to address some of the limitations associated with Ethereum, such as high gas fees and scalability issues.

- Polygon (Matic): Uniswap is available on the Polygon network, which offers faster transactions and lower fees compared to Ethereum. This integration allows users to trade with minimal costs while benefiting from the security of Ethereum through Polygon’s layer 2 scaling solution.

- Arbitrum: Uniswap has also been deployed on Arbitrum, another layer 2 solution that provides enhanced scalability and lower transaction costs. Arbitrum is designed to improve the user experience by reducing congestion on the Ethereum mainnet.

- Optimism: As a layer 2 scaling solution, Optimism helps Uniswap users enjoy faster transaction times and reduced fees. This integration aims to enhance the overall efficiency and accessibility of the Uniswap platform.

Using Uniswap on Different Networks

Setting Up Wallets

To use Uniswap on various networks, it’s essential to set up compatible wallets that support multiple blockchains. Here’s how to get started:

- Choose a Compatible Wallet: Select a wallet that supports Ethereum and the other networks you plan to use, such as MetaMask, Trust Wallet, or Coinbase Wallet.

- Install the Wallet: Download and install the chosen wallet from a trusted source. Follow the setup instructions to create a new wallet or import an existing one using your recovery phrase.

- Add Networks: Configure your wallet to support additional networks like Polygon, Arbitrum, and Optimism.

- MetaMask: In MetaMask, open the network dropdown menu, select “Custom RPC,” and enter the necessary network details (RPC URL, chain ID, and network name).

- Trust Wallet: Trust Wallet automatically supports multiple networks, so ensure your wallet is up-to-date.

- Coinbase Wallet: Coinbase Wallet also supports various networks, but you may need to manually add custom networks through the settings.

Switching Between Networks

Switching between networks on Uniswap allows you to trade on different blockchains with varying fees and transaction speeds. Follow these steps to switch networks:

- Open Your Wallet: Launch your wallet app and ensure it’s connected to the internet.

- Select the Network: In MetaMask, click on the network dropdown menu at the top of the wallet interface and select the desired network (e.g., Ethereum, Polygon, Arbitrum, Optimism).

- Connect to Uniswap: Visit the Uniswap app (app.uniswap.org) and connect your wallet. Uniswap will automatically detect the network you’re connected to.

- Switch Networks on Uniswap: If you need to switch networks while using Uniswap, change the network in your wallet first. Uniswap will prompt you to switch networks if it detects a mismatch.

- Confirm Network Change: After switching networks in your wallet, confirm any prompts to ensure the change is successful. You can now trade on the selected network with Uniswap.

Fees and Costs

Ethereum Network Fees

When using Uniswap on the Ethereum network, users encounter specific fees associated with transactions. These fees, known as gas fees, are required to process and validate transactions on the Ethereum blockchain.

- Gas Fees: Gas fees are the transaction costs paid to miners for processing and securing transactions on the Ethereum network. These fees vary based on network congestion and the complexity of the transaction.

- High Costs: During periods of high network activity, gas fees on Ethereum can become quite expensive, making small transactions less economical.

- Fee Calculation: Gas fees are calculated in gwei, a subunit of Ether (ETH). The total cost depends on the gas price (gwei per unit of gas) and the amount of gas required for the transaction.

- Strategies to Reduce Fees: Users can reduce fees by trading during off-peak times, setting lower gas prices (though this may result in slower transaction times), and using gas-saving techniques such as batching transactions.

Fees on Other Networks

Uniswap’s expansion to other networks like Polygon, Arbitrum, and Optimism aims to address the high gas fees on Ethereum by offering lower-cost alternatives.

- Polygon Network Fees: Transactions on the Polygon network are significantly cheaper than on Ethereum. Polygon uses a proof-of-stake (PoS) consensus mechanism, which reduces the computational effort required for each transaction.

- Low Gas Fees: Typically, gas fees on Polygon are a fraction of a cent, making it an attractive option for users seeking lower costs.

- Fast Transactions: Polygon also offers faster transaction times compared to Ethereum, enhancing the overall user experience.

- Arbitrum Network Fees: Arbitrum, a layer 2 solution for Ethereum, provides lower fees by processing transactions off-chain and then settling them on the Ethereum mainnet.

- Reduced Gas Costs: Users benefit from reduced gas fees while still enjoying the security and decentralization of the Ethereum network.

- Scalability: Arbitrum improves scalability, allowing more transactions to be processed simultaneously, further lowering costs.

- Optimism Network Fees: Similar to Arbitrum, Optimism is a layer 2 scaling solution that reduces transaction fees and increases throughput.

- Cost-Effective Transactions: By using optimistic rollups, Optimism significantly reduces the cost of transactions while maintaining Ethereum’s security standards.

- Enhanced Speed: Transactions on Optimism are processed quickly, making it a viable option for users seeking efficiency and lower fees.

Security and Risks

Security on Ethereum

Using Uniswap on the Ethereum network provides a high level of security due to Ethereum’s robust infrastructure and decentralized nature. However, users should be aware of certain risks.

- Smart Contract Security: Uniswap’s smart contracts are open-source and have been audited for security. This transparency helps ensure the integrity of the contracts.

- Decentralization: Ethereum’s decentralized nature reduces the risk of a single point of failure, enhancing overall security.

- Network Security: Ethereum has a large, distributed network of nodes, which contributes to its security against attacks such as 51% attacks.

- Risks: Despite its security, Ethereum is not immune to risks such as smart contract vulnerabilities, phishing attacks, and network congestion. Users should remain vigilant and follow best practices to safeguard their assets.

Security on Other Networks

Uniswap’s expansion to other networks like Polygon, Arbitrum, and Optimism also offers strong security, though there are unique considerations for each network.

- Polygon Security:

- Layer 2 Benefits: Polygon operates as a layer 2 solution, enhancing security by leveraging Ethereum’s base layer.

- Validator Network: Polygon employs a robust validator network to secure transactions, ensuring that the network remains decentralized and resistant to attacks.

- Risks: Users should be aware of potential risks such as bridge vulnerabilities and the need to trust Polygon’s security measures in addition to Ethereum’s.

- Arbitrum Security:

- Off-Chain Security: Arbitrum processes transactions off-chain and settles them on Ethereum, combining the security of Ethereum with the efficiency of layer 2 solutions.

- Fraud Proofs: Arbitrum uses fraud proofs to detect and correct malicious transactions, enhancing security.

- Risks: While generally secure, Arbitrum’s reliance on off-chain processing introduces risks related to bridge security and the trustworthiness of validators.

- Optimism Security:

- Optimistic Rollups: Optimism employs optimistic rollups to increase transaction throughput and reduce costs, while maintaining security through Ethereum’s mainnet.

- Fraud Detection: Similar to Arbitrum, Optimism uses fraud proofs to ensure transaction validity, providing a mechanism to resolve disputes and maintain security.

- Risks: Users should consider the risks associated with bridge security and potential vulnerabilities in the rollup technology.

Advantages of Using Uniswap

Liquidity and Trading Volume

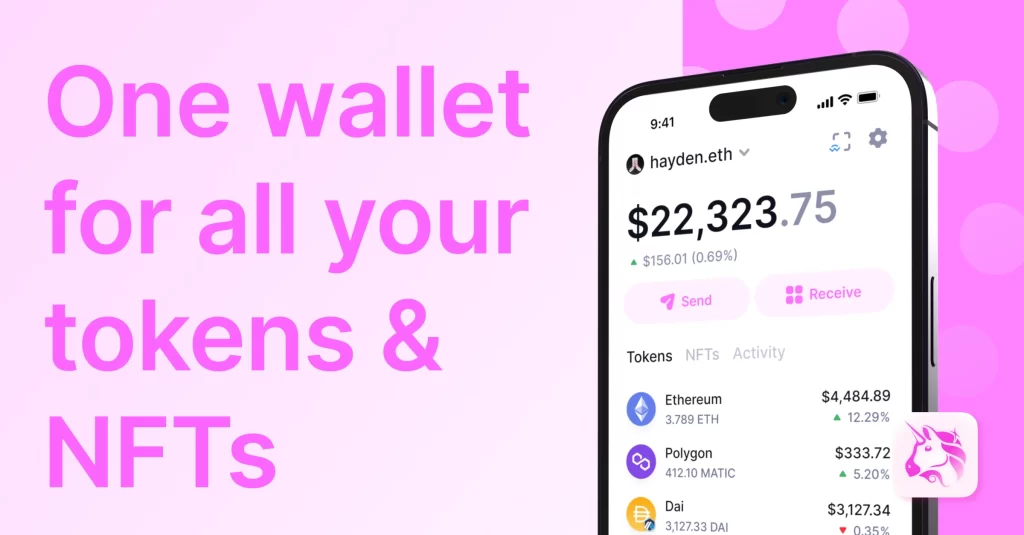

Uniswap is one of the most popular decentralized exchanges, offering significant advantages in terms of liquidity and trading volume.

- High Liquidity: Uniswap has substantial liquidity pools, which allow users to execute large trades with minimal slippage. This high liquidity is supported by numerous liquidity providers who earn fees for their contributions.

- Popular Token Pairs: The platform supports a wide range of token pairs, making it easier for users to find and trade their preferred cryptocurrencies.

- Continuous Trading: Unlike centralized exchanges, Uniswap operates 24/7 without downtime, enabling continuous trading opportunities for users.

- Volume Advantages: High trading volumes on Uniswap contribute to tighter spreads and better pricing for users, enhancing the overall trading experience.

User Experience Across Networks

Using Uniswap across different networks offers a variety of user experience benefits, catering to different needs and preferences.

- Ethereum Network:

- Established Ecosystem: As the original platform for Uniswap, Ethereum provides a mature and well-integrated ecosystem. Users benefit from extensive DeFi integrations and a wide array of supported tokens.

- Security and Reliability: Ethereum’s robust security measures and decentralization offer a reliable trading environment, though users should be prepared for higher gas fees during peak times.

- Polygon Network:

- Lower Fees: Trading on the Polygon network incurs significantly lower fees compared to Ethereum, making it an attractive option for users looking to minimize costs.

- Fast Transactions: Polygon offers quicker transaction times, enhancing the user experience by reducing waiting periods for trade execution.

- Seamless Integration: Polygon integrates smoothly with Ethereum, allowing users to move assets between the two networks easily.

- Arbitrum Network:

- Scalability: Arbitrum’s layer 2 solution provides enhanced scalability, enabling more transactions to be processed simultaneously. This reduces congestion and improves overall network performance.

- Cost Efficiency: Lower gas fees on Arbitrum make it cost-effective for users to trade frequently or in smaller amounts.

- Security Assurances: By leveraging Ethereum’s security for settlement, Arbitrum offers a secure trading environment with the added benefits of layer 2 scaling.

- Optimism Network:

- High Throughput: Optimism’s optimistic rollups allow for high transaction throughput, improving the speed and efficiency of trades.

- Reduced Costs: Users benefit from reduced transaction costs, similar to other layer 2 solutions, making trading more accessible and affordable.

- User-Friendly: Optimism provides a user-friendly experience with straightforward integration into existing Ethereum-based tools and wallets.

Future Developments

Upcoming Features on Ethereum

Uniswap continues to innovate and expand its offerings on the Ethereum network. Several upcoming features are expected to enhance user experience and platform capabilities.

- Layer 2 Integration: To address high gas fees and scalability issues, Uniswap plans to integrate more deeply with Ethereum’s layer 2 solutions like Optimism and Arbitrum, providing faster and cheaper transactions.

- V3 Enhancements: Following the release of Uniswap V3, future updates are expected to bring further optimizations to the capital efficiency and liquidity management features, making trading more cost-effective.

- Governance Improvements: Enhancements in the governance process will allow for more decentralized decision-making, giving users and stakeholders greater control over protocol changes and upgrades.

- Cross-Chain Functionality: Integration with cross-chain bridges will enable seamless asset transfers between Ethereum and other blockchains, expanding Uniswap’s reach and usability.

- Enhanced Analytics: New tools and dashboards for better trade analytics and user insights are in development, helping traders make more informed decisions.

Expansion to Additional Blockchains

Uniswap’s vision includes expanding its protocol to other blockchains beyond Ethereum to enhance accessibility and reduce transaction costs for users.

- Binance Smart Chain (BSC): Uniswap is exploring integration with Binance Smart Chain, known for its low fees and high throughput. This would allow users to trade with significantly reduced transaction costs.

- Solana: Solana’s high-speed, low-cost blockchain is another target for Uniswap expansion. Solana’s scalability could offer a robust alternative for users looking for efficient trading experiences.

- Avalanche: With its rapid transaction processing and low fees, Avalanche is an attractive option for Uniswap’s future deployments, aiming to provide users with more diverse and cost-effective trading environments.

- Polkadot: Leveraging Polkadot’s interoperability, Uniswap could enable cross-chain trading capabilities, allowing assets from various blockchains to be traded seamlessly on its platform.

- Cosmos: By integrating with Cosmos and its Inter-Blockchain Communication (IBC) protocol, Uniswap could facilitate broader connectivity and asset transfers across multiple blockchain ecosystems.