No, Uniswap does not require ID or KYC verification to use its platform. Users can trade directly from their wallets while maintaining privacy and anonymity.

Overview of Uniswap

What is Uniswap?

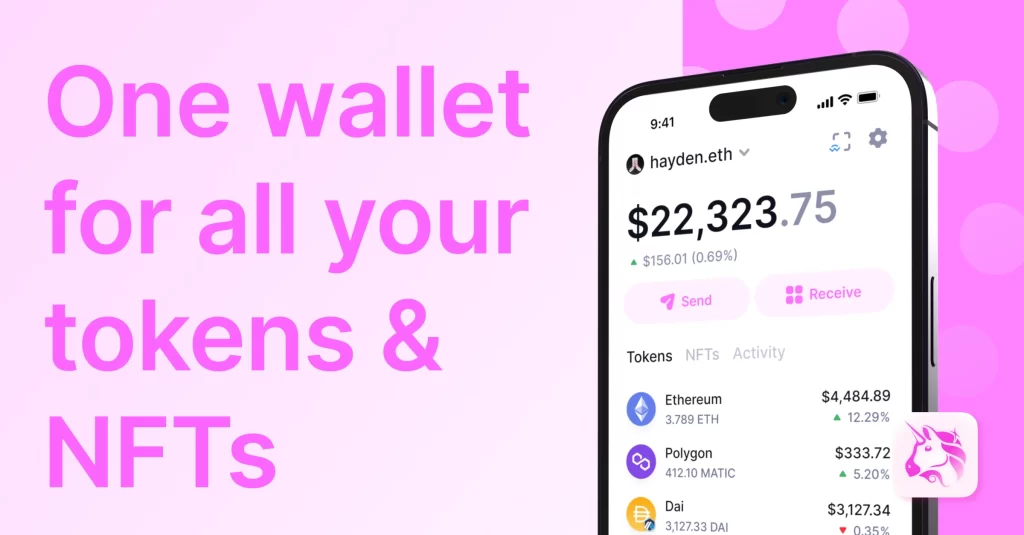

Uniswap is a decentralized exchange (DEX) on the Ethereum blockchain, allowing users to trade ERC-20 tokens directly from their wallets.

- Decentralized Platform: Operates without intermediaries, using smart contracts to execute trades.

- ERC-20 Tokens: Supports a wide range of ERC-20 tokens for trading.

- Liquidity Pools: Uses liquidity pools instead of order books, where users can provide liquidity and earn a share of trading fees.

How Does Uniswap Work?

Uniswap uses an automated market maker (AMM) model to facilitate trades.

- AMM Model: Determines token prices based on the ratio of tokens in liquidity pools, ensuring constant liquidity.

- Providing Liquidity: Users deposit an equal value of two tokens into a pool and earn a portion of the trading fees.

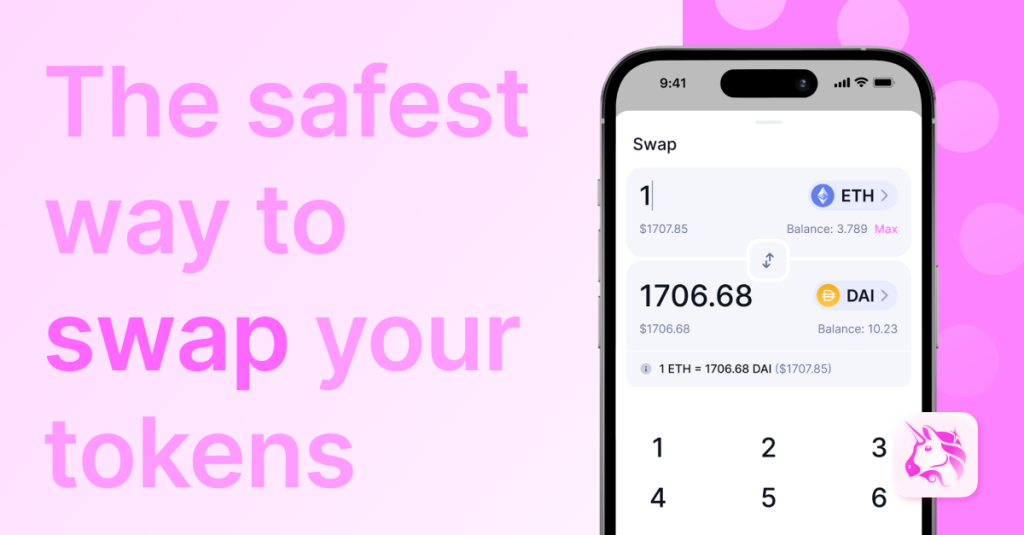

- Swapping Tokens: Connect a wallet, select tokens to trade, and execute the swap instantly via the AMM algorithm.

- Gas Fees: Paid to Ethereum miners, varying based on network congestion.

- Slippage Tolerance: Users can set a slippage tolerance to minimize the impact of price fluctuations during transactions.

KYC and AML Requirements

Does Uniswap Require KYC?

Uniswap, as a decentralized exchange (DEX), operates differently from traditional centralized exchanges.

- No KYC Required: Uniswap does not require users to complete Know Your Customer (KYC) verification processes. Users can trade directly from their wallets without providing personal identification information.

- Decentralized Nature: The lack of KYC is possible because Uniswap is fully decentralized, with trades executed via smart contracts rather than a central authority.

Understanding AML Regulations

Anti-Money Laundering (AML) regulations are designed to prevent illegal activities such as money laundering and terrorism financing.

- Regulatory Landscape: While Uniswap itself does not enforce AML regulations directly, users must still comply with the laws of their respective jurisdictions.

- Responsibility of Users: It is the responsibility of users to ensure that their activities on Uniswap comply with local AML regulations.

- Potential Changes: The regulatory environment for decentralized finance (DeFi) is evolving, and future regulations may impact how DEXs like Uniswap operate. Users should stay informed about any changes in regulations that may affect their use of the platform.

Trading on Uniswap

Steps to Trade on Uniswap

Trading on Uniswap is straightforward and user-friendly. Here’s a step-by-step guide to help you get started:

- Connect Your Wallet:

- Open the Uniswap website.

- Click on “Connect Wallet” and choose your Ethereum-compatible wallet (e.g., MetaMask, Trust Wallet).

- Authorize the connection within your wallet application.

- Select Tokens:

- In the swap interface, choose the token you want to trade from (e.g., ETH).

- Select the token you want to trade to (e.g., DAI).

- Enter Trade Amount:

- Enter the amount of the token you want to swap.

- The interface will automatically display the estimated amount of the target token you will receive.

- Adjust Slippage Tolerance:

- Click on the settings icon to adjust slippage tolerance if needed.

- Set a slippage tolerance to ensure your trade executes within acceptable price fluctuations.

- Review Trade Details:

- Check the details of your trade, including the exchange rate and the estimated amount of the target token.

- Ensure the gas fee is acceptable.

- Confirm and Execute:

- Click “Swap” and confirm the transaction in your wallet.

- Wait for the transaction to be processed and confirmed on the Ethereum blockchain.

Privacy and Anonymity

Uniswap offers a high degree of privacy and anonymity compared to traditional centralized exchanges.

- No KYC Requirements:

- Uniswap does not require Know Your Customer (KYC) verification, allowing users to trade without providing personal information.

- Users remain anonymous, identified only by their wallet addresses.

- On-Chain Privacy:

- While trades are recorded on the Ethereum blockchain, personal identities are not linked to transactions.

- Blockchain explorers can track wallet activity, but they do not reveal personal details unless linked to off-chain data.

- Best Practices for Privacy:

- Use a new or dedicated wallet for specific trading activities to enhance privacy.

- Avoid sharing your wallet address publicly to reduce the risk of linking your identity to your trades.

Using Wallets with Uniswap

Supported Wallets

To trade on Uniswap, you need an Ethereum-compatible wallet. Here are some of the most popular options:

- MetaMask: A widely used browser extension and mobile wallet that supports Ethereum and ERC-20 tokens.

- Trust Wallet: A mobile wallet that supports multiple cryptocurrencies and offers a user-friendly interface.

- Coinbase Wallet: A standalone app from Coinbase that allows users to manage their crypto and interact with decentralized applications.

- WalletConnect: A protocol that connects decentralized applications to mobile wallets using QR code scanning.

- Ledger and Trezor: Hardware wallets that provide enhanced security by keeping private keys offline.

Connecting Your Wallet

Connecting your wallet to Uniswap is a simple process. Follow these steps:

- Open Uniswap: Navigate to the official Uniswap website (app.uniswap.org).

- Connect Wallet: Click on the “Connect Wallet” button in the top right corner of the interface.

- Select Your Wallet: Choose your wallet type from the list of options (e.g., MetaMask, WalletConnect, Coinbase Wallet).

- Authorize Connection:

- MetaMask: If using MetaMask, a popup will appear asking you to authorize the connection. Click “Next” and then “Connect”.

- Trust Wallet: If using Trust Wallet, open the app, scan the QR code with WalletConnect, and authorize the connection.

- Coinbase Wallet: If using Coinbase Wallet, follow the prompts in the app to connect to Uniswap.

- Confirmation: Once connected, your wallet address will appear in the top right corner of the Uniswap interface, indicating a successful connection.

- Start Trading: You can now start swapping tokens, providing liquidity, and using other features available on Uniswap.

Security Measures

Protecting Your Identity

When using Uniswap, it’s crucial to protect your identity to maintain privacy and security.

- No KYC Requirements: Uniswap does not require Know Your Customer (KYC) verification, so avoid sharing personal information unnecessarily.

- Use Separate Wallets: Consider using separate wallets for different activities to prevent linking all your transactions to a single identity.

- Avoid Publicly Sharing Wallet Addresses: Do not share your wallet address publicly, as this can be used to track your transaction history.

- Anonymous Browsing: Use privacy-focused browsers and VPNs to enhance your online anonymity.

Ensuring Safe Transactions

Ensuring safe transactions on Uniswap involves several best practices:

- Verify Website URL: Always use the official Uniswap website (app.uniswap.org) to avoid phishing scams. Bookmark the URL to prevent visiting malicious sites.

- Enable Two-Factor Authentication (2FA): Use wallets that support 2FA for an additional layer of security.

- Secure Private Keys: Keep your private keys and recovery phrases secure. Store them offline in a safe place, and never share them online.

- Monitor Transactions: Regularly monitor your wallet for unauthorized transactions. Use tools like Etherscan to track and verify your transaction history.

- Update Wallet Software: Ensure your wallet software is up-to-date to benefit from the latest security patches and features.

- Be Cautious with Approvals: When interacting with new contracts or dApps, review and limit the permissions granted to them.

- Use Hardware Wallets: For enhanced security, use hardware wallets like Ledger or Trezor to store your assets offline and sign transactions securely.

Regulatory Compliance

Uniswap’s Compliance with Regulations

Uniswap operates within the framework of existing financial regulations, but as a decentralized platform, its compliance mechanisms differ from those of traditional financial institutions.

- Decentralized Nature: Uniswap is a decentralized exchange (DEX) that relies on smart contracts and does not have a central authority overseeing transactions. This means that it does not collect personal data or perform Know Your Customer (KYC) checks directly.

- Self-Custody: Users retain control of their funds and private keys at all times, enhancing privacy and reducing the need for centralized oversight.

- Transparency: All transactions on Uniswap are publicly recorded on the Ethereum blockchain, providing transparency and traceability without compromising user privacy.

- Legal Obligations: While Uniswap itself does not enforce KYC/AML regulations, it encourages users to comply with local laws and regulations applicable to their use of the platform.

- Developer Responsibility: The Uniswap team adheres to legal standards relevant to software development and distribution, ensuring the platform’s codebase is secure and compliant with applicable regulations.

Future Regulatory Changes

As the decentralized finance (DeFi) landscape evolves, so do the regulatory frameworks governing it. Here are potential future regulatory changes that could impact Uniswap:

- Increased Oversight: Governments and regulatory bodies may introduce new regulations specifically targeting DeFi platforms to enhance user protection and prevent illicit activities such as money laundering and fraud.

- KYC/AML Requirements: Future regulations might require DeFi platforms, including Uniswap, to implement some form of KYC/AML procedures, potentially impacting the level of anonymity currently offered.

- Tax Reporting: Regulatory changes could mandate more stringent reporting requirements for DeFi transactions to ensure proper tax compliance by users.

- Smart Contract Audits: There could be increased emphasis on the security and auditability of smart contracts, requiring regular audits and certifications to ensure safety and compliance.

- Cross-Border Regulations: International regulatory standards may become more harmonized, leading to consistent compliance requirements for users globally.

Advantages of Decentralized Exchanges

Privacy Benefits

Decentralized exchanges (DEXs) like Uniswap offer significant privacy advantages over traditional centralized exchanges.

- No KYC Requirements: DEXs do not require users to undergo Know Your Customer (KYC) verification, allowing for greater privacy and anonymity.

- Self-Custody: Users retain control of their private keys and funds, reducing the need to trust a central authority with their personal information.

- On-Chain Privacy: Transactions are recorded on the blockchain without linking to personal identities. Users are identified only by their wallet addresses, enhancing privacy.

- Reduced Data Collection: DEXs do not collect personal data, minimizing the risk of data breaches and identity theft.

Accessibility and Global Use

Decentralized exchanges offer unparalleled accessibility and usability for users around the world.

- Global Accessibility: Anyone with an internet connection can access and use a DEX, regardless of their geographic location. This democratizes access to financial services.

- No Account Restrictions: Users do not need to create accounts or face restrictions based on nationality or residency, making DEXs inclusive for all.

- 24/7 Operation: DEXs operate around the clock, providing continuous access to trading without the limitations of traditional market hours.

- Lower Barriers to Entry: With no need for extensive documentation or verification processes, users can start trading immediately.

- Censorship Resistance: DEXs are less susceptible to censorship and regulatory crackdowns, as they do not rely on a central entity to operate.

- Cross-Border Transactions: DEXs facilitate seamless cross-border transactions without the need for intermediaries, reducing costs and delays associated with international transfers.