Uniswap is a decentralized exchange accessible via a website, not a standalone app. You can use it through web browsers and compatible mobile wallets like MetaMask and Trust Wallet.

Understanding Uniswap’s Platform

Uniswap is a decentralized exchange (DEX) protocol that allows users to swap Ethereum-based tokens without relying on a centralized intermediary. It operates on the Ethereum blockchain and uses smart contracts to facilitate automated transactions between cryptocurrency tokens.

Overview of Uniswap

Uniswap has revolutionized the way people trade cryptocurrencies by providing a decentralized and permissionless platform. Here’s an in-depth look at what makes Uniswap unique:

- Decentralized Exchange: Unlike traditional exchanges, Uniswap doesn’t require users to deposit funds into an account. Instead, users trade directly from their wallets.

- Automated Market Maker (AMM): Uniswap uses an AMM model, which means it relies on liquidity pools rather than order books to determine prices. Liquidity providers add funds to these pools and earn fees from trades.

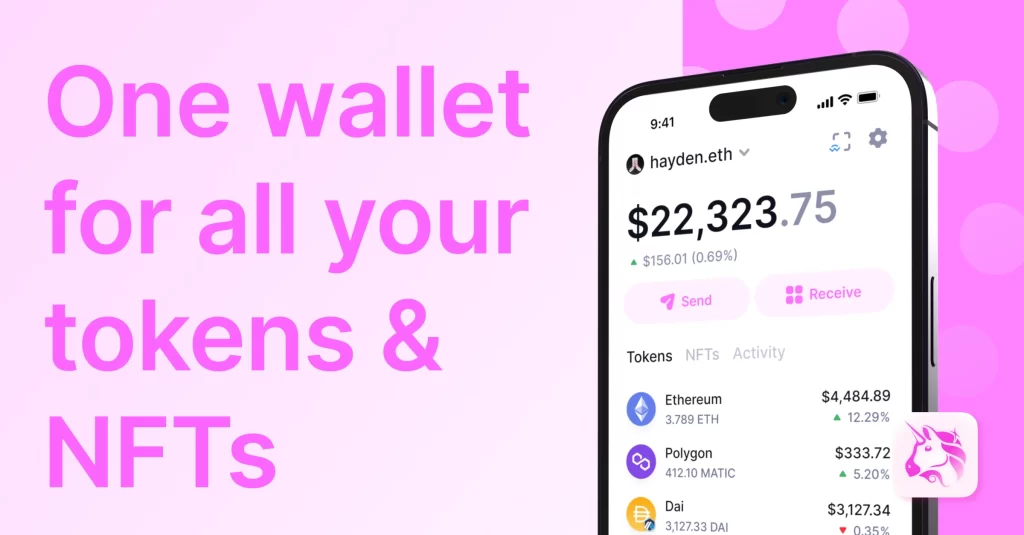

- ERC-20 Token Support: Uniswap supports any ERC-20 token, making it a versatile platform for trading a wide variety of cryptocurrencies on the Ethereum network.

Key Features of Uniswap

Uniswap’s key features contribute to its popularity and widespread use within the DeFi ecosystem:

- Liquidity Pools: Users can provide liquidity by depositing an equal value of two tokens into a pool. In return, they receive liquidity provider (LP) tokens, which entitle them to a share of the trading fees.

- Permissionless Trading: Anyone with an Ethereum wallet can trade on Uniswap without needing to create an account or provide personal information.

- Transparent and Trustless: All transactions are executed via smart contracts, ensuring transparency and eliminating the need for trust in a centralized entity.

- Community Governance: Uniswap’s development and future upgrades are governed by its community through the UNI token. UNI holders can propose and vote on changes to the protocol.

- Integration with Wallets: Uniswap can be easily accessed through popular Ethereum wallets like MetaMask, Trust Wallet, and Coinbase Wallet, allowing seamless trading directly from the wallet interface.

- Flash Swaps: This feature allows users to withdraw up to the full reserves of any ERC-20 token on Uniswap, use them elsewhere, and return them by the end of the transaction, all within one atomic transaction.

- Oracles for Price Feeds: Uniswap V2 introduced time-weighted average price (TWAP) oracles, which provide reliable price data that can be used by other DeFi protocols.

Accessing Uniswap

Uniswap can be accessed in various ways to accommodate different user preferences and devices. Whether you prefer using a web browser on your computer or mobile options, Uniswap provides a seamless experience for trading and managing your crypto assets.

Using Uniswap on the Web

Accessing Uniswap via a web browser is straightforward and provides the full functionality of the platform. Here’s how to get started:

Navigating to Uniswap

- Official Website: Visit the official Uniswap website at uniswap.org. It’s crucial to ensure you are on the correct site to avoid phishing scams.

- Launching the App: Click on the “Launch App” button to access the Uniswap interface. This will take you to the trading platform where you can connect your wallet and start trading.

Connecting Your Wallet

- MetaMask: If you use MetaMask, ensure it is installed and set up in your browser. Click on “Connect Wallet” in the Uniswap interface and select MetaMask. Follow the prompts to connect.

- Other Wallets: Uniswap supports various other wallets such as WalletConnect, Coinbase Wallet, and Fortmatic. Choose your preferred wallet and follow the connection steps.

Trading on Uniswap

- Selecting Tokens: Choose the tokens you want to trade by selecting them from the dropdown menus in the “Swap” interface.

- Confirming Transactions: Enter the amount, review the details, and confirm the transaction in your wallet. Uniswap will handle the rest using smart contracts.

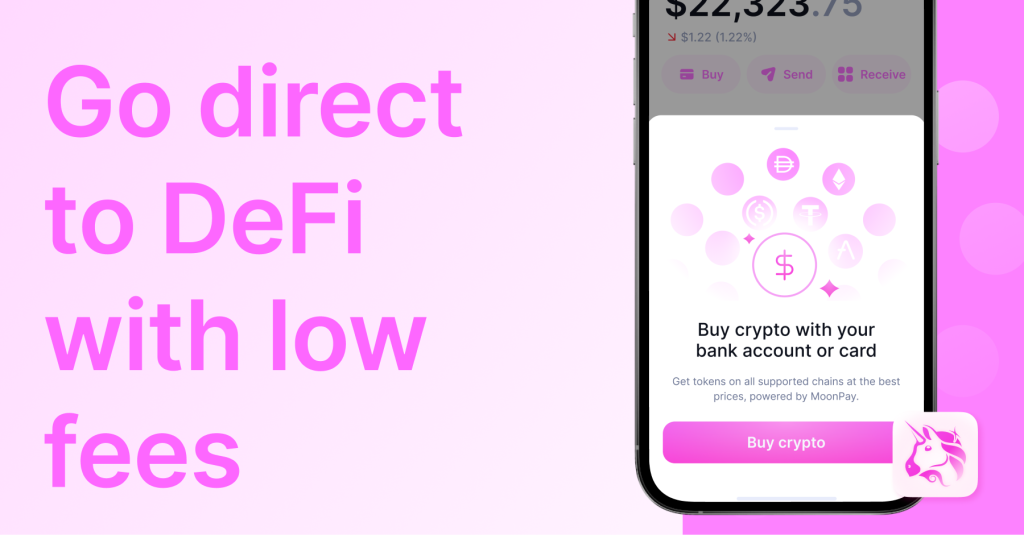

Mobile Access Options

For users who prefer trading on the go, Uniswap can be accessed via mobile wallets with built-in dApp browsers.

Using MetaMask Mobile

- Install MetaMask: Download the MetaMask app from the App Store or Google Play Store and set it up.

- Access dApp Browser: Open MetaMask and tap the browser icon to navigate to uniswap.org. Launch the app from there.

- Connect and Trade: Connect your wallet and follow the same trading steps as you would on the web.

Using Trust Wallet

- Install Trust Wallet: Download Trust Wallet from the App Store or Google Play Store and set it up.

- Use Built-in Browser: Open Trust Wallet and use the built-in dApp browser to go to uniswap.org. Launch the app.

- Connect and Trade: Connect your wallet, select tokens, and confirm transactions as usual.

Other Mobile Wallets

- Coinbase Wallet: Similar to MetaMask and Trust Wallet, Coinbase Wallet provides a built-in browser to access Uniswap.

- WalletConnect: Many mobile wallets support WalletConnect, allowing you to connect to Uniswap via a QR code scan.

Security and Authenticity

Ensuring the security and authenticity of your interactions with Uniswap is crucial for protecting your crypto assets. This involves verifying the official Uniswap website and avoiding phishing attempts and fake apps.

Verifying the Uniswap Website

To safely access Uniswap and avoid phishing sites, always verify that you are using the correct website.

Official Website Address

- Correct URL: The official Uniswap website is uniswap.org. Always double-check the URL before entering any sensitive information.

- Bookmark the Official Site: Bookmark uniswap.org in your browser to ensure you always visit the correct site.

SSL Certificate

- Check for HTTPS: Ensure that the website uses HTTPS. Look for the padlock icon in the address bar, indicating a secure connection.

- Certificate Details: Click on the padlock icon to view the SSL certificate details. The certificate should be issued to uniswap.org by a trusted certificate authority.

Links from Reputable Sources

- Official Sources: Access Uniswap through links provided by trusted sources such as the official Uniswap Twitter account, Discord server, or documentation.

- Avoiding Suspicious Links: Do not click on links from unknown sources or unsolicited emails claiming to be Uniswap.

Avoiding Phishing and Fake Apps

Phishing attacks and fake apps are common threats in the crypto space. Here’s how to avoid them:

Recognizing Phishing Sites

- Suspicious URLs: Be cautious of URLs that look similar to uniswap.org but have slight variations, such as extra characters or misspellings.

- Unexpected Pop-ups: Beware of unexpected pop-ups asking for your private keys or seed phrases. Uniswap will never ask for this information.

Using Trusted Wallets

- Official Apps: Download wallet apps like MetaMask and Trust Wallet only from official app stores (Google Play Store, Apple App Store) or their official websites.

- Check Developer Info: Ensure the app is developed by the legitimate company (e.g., “MetaMask – Blockchain Wallet” for MetaMask).

Security Practices

- Never Share Your Private Keys: Do not share your private keys or seed phrases with anyone. These are the keys to your wallet and must be kept secure.

- Enable Two-Factor Authentication (2FA): Use 2FA on your wallet and any associated email accounts for an additional layer of security.

- Update Regularly: Keep your wallet apps and browsers updated to protect against the latest security vulnerabilities.

Reporting Scams

- Report Fake Sites: If you encounter a phishing site or fake app, report it to the relevant platform (e.g., Google, Apple, or the wallet provider).

- Inform the Community: Share your experience on official Uniswap community channels to alert other users about potential threats.

Integrating with Wallets

To use Uniswap effectively, you need a compatible wallet that can securely manage your crypto assets and interact with decentralized applications. Here’s how to integrate Uniswap with compatible wallets, focusing on the popular MetaMask wallet.

Compatible Wallets for Uniswap

Uniswap supports a variety of wallets, each offering unique features and security measures.

MetaMask

- Browser Extension: Available for Chrome, Firefox, and Brave browsers.

- Mobile App: Offers a mobile version with a built-in dApp browser.

Trust Wallet

- Mobile App: Available for both Android and iOS, Trust Wallet supports a wide range of cryptocurrencies and provides a built-in dApp browser.

Coinbase Wallet

- Mobile App: A mobile wallet provided by Coinbase, which supports Ethereum and ERC-20 tokens. It also has a built-in dApp browser.

WalletConnect

- Protocol: WalletConnect is not a wallet itself but a protocol that connects many different mobile wallets to dApps using QR codes.

Setting Up MetaMask for Uniswap

MetaMask is one of the most widely used wallets for interacting with Uniswap due to its ease of use and robust security features. Here’s how to set it up:

Installing MetaMask

- Visit the Official Website: Go to the official MetaMask website at metamask.io.

- Choose Your Browser: Select the browser you are using (Chrome, Firefox, or Brave) and click on the appropriate link to go to the browser’s extension store.

- Add to Browser: Click “Add to [Browser]” and follow the prompts to install the extension. The MetaMask icon will appear in your browser’s toolbar once installed.

Setting Up Your Wallet

- Open MetaMask: Click on the MetaMask icon in your browser’s toolbar to open the extension.

- Create a New Wallet: If you don’t have an existing MetaMask wallet, click “Get Started” and then select “Create a Wallet.”

- Set a Password: Create a strong password to secure your wallet. This password will be used to unlock MetaMask on your device.

- Backup Your Seed Phrase: MetaMask will generate a 12-word seed phrase. Write this phrase down and store it securely. This phrase is essential for recovering your wallet if you lose access.

- Confirm Seed Phrase: Verify your seed phrase by selecting the words in the correct order as prompted by MetaMask.

- Complete Setup: Once confirmed, your MetaMask wallet is set up and ready to use.

Connecting MetaMask to Uniswap

- Visit Uniswap: Go to the official Uniswap website at uniswap.org.

- Launch the App: Click on “Launch App” to access the Uniswap trading interface.

- Connect Wallet: In the top right corner of the Uniswap interface, click on “Connect Wallet.”

- Select MetaMask: Choose MetaMask from the list of available wallet options. A MetaMask pop-up will appear, prompting you to connect your wallet to Uniswap.

- Authorize Connection: Select the account you want to use (if you have multiple accounts) and click “Next,” then “Connect” to authorize the connection.

Trading on Uniswap

- Select Tokens: In the Uniswap interface, choose the tokens you want to trade by filling in the “From” and “To” fields.

- Enter Amount: Input the amount you want to trade. The corresponding amount of the receiving token will be automatically calculated.

- Review Details: Check the transaction details, including the exchange rate and gas fees.

- Approve Token: If trading a token for the first time, you may need to approve it. Confirm the approval in MetaMask.

- Execute Swap: Click “Swap,” review the transaction summary, and confirm the swap in MetaMask.

Trading on Uniswap

Trading on Uniswap involves two main activities: swapping tokens and providing liquidity. Here’s a detailed guide on how to perform these actions on the Uniswap platform.

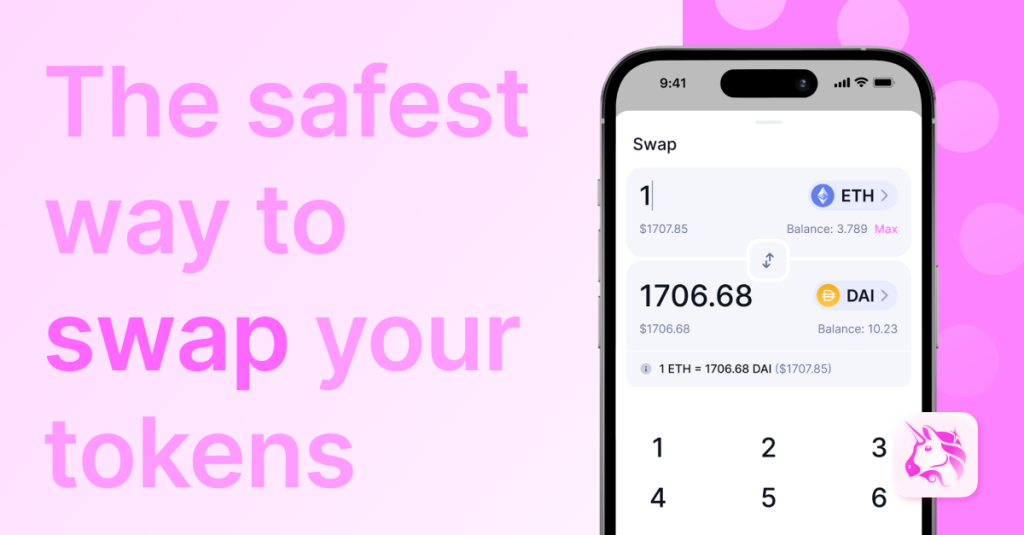

How to Swap Tokens

Swapping tokens on Uniswap is a straightforward process. Here’s how you can do it:

Selecting Tokens

- Open Uniswap: Go to the Uniswap website (uniswap.org) and click on “Launch App” to access the trading interface.

- Connect Your Wallet: Click “Connect Wallet” and select your wallet (e.g., MetaMask, Trust Wallet). Follow the prompts to authorize the connection.

- Choose Tokens: In the “Swap” interface, select the token you want to trade in the “From” field. You can search for the token by name or paste its contract address.

- Select the Receiving Token: In the “To” field, select the token you want to receive. Similarly, you can search for it by name or contract address.

Entering Trade Details

- Enter Amount: Input the amount of the token you want to swap in the “From” field. The corresponding amount of the receiving token will be automatically calculated and displayed in the “To” field.

- Review Price and Fees: Check the current exchange rate, slippage tolerance, and estimated gas fees. Adjust the slippage tolerance if necessary to account for price fluctuations.

Confirming the Swap

- Approve Token (if needed): If you are swapping a token for the first time, you might need to approve it first. Click “Approve [Token]” and confirm the approval in your wallet.

- Execute Swap: Click “Swap” and review the transaction details in the confirmation window. Confirm the swap by clicking “Confirm Swap” in Uniswap, then approve the transaction in your wallet.

- Wait for Confirmation: The transaction will be submitted to the Ethereum network. You can track its status in your wallet or using a blockchain explorer like Etherscan. Once confirmed, the swapped tokens will appear in your wallet.

Providing Liquidity on Uniswap

Providing liquidity on Uniswap allows you to earn fees from trading activities. Here’s how you can add liquidity to a pool:

Selecting a Pool

- Open Uniswap: Go to the Uniswap website and launch the app.

- Connect Your Wallet: Click “Connect Wallet” and select your wallet. Follow the prompts to connect.

- Navigate to Pool: Click on the “Pool” tab at the top of the Uniswap interface.

- Add Liquidity: Click “Add Liquidity” to start the process.

Adding Liquidity

- Select Token Pair: Choose the two tokens you want to provide liquidity for. You can select from existing pairs or create a new one.

- Enter Amounts: Input the amount of each token you want to deposit. The interface will automatically calculate the equivalent amount needed for the other token based on the current exchange rate.

- Approve Tokens: If you are providing liquidity for the first time, you might need to approve each token. Click “Approve [Token]” and confirm the approval in your wallet.

Confirming the Deposit

- Review Details: Check the amounts, pool share, and any potential impact on the pool’s liquidity.

- Supply Liquidity: Click “Supply” and review the transaction details in the confirmation window. Confirm the supply by clicking “Confirm Supply” in Uniswap, then approve the transaction in your wallet.

- Wait for Confirmation: The transaction will be submitted to the Ethereum network. Once confirmed, you will receive Liquidity Provider (LP) tokens in your wallet, representing your share of the pool.

Managing Liquidity

- Earning Fees: As a liquidity provider, you will earn a share of the trading fees proportional to your share of the pool.

- Removing Liquidity: You can remove your liquidity at any time by navigating to the “Pool” tab, selecting the pool, and clicking “Remove Liquidity.” Confirm the amount to remove and complete the transaction in your wallet.

Uniswap and DeFi Ecosystem

Uniswap plays a significant role in the decentralized finance (DeFi) ecosystem, serving as a primary decentralized exchange (DEX) platform for trading Ethereum-based tokens. Its innovative approach to liquidity and trading has paved the way for various integrations with other DeFi applications.

Uniswap’s Role in DeFi

Uniswap has become a cornerstone of the DeFi ecosystem due to its unique features and contributions:

Decentralized Trading

- Permissionless Trading: Uniswap allows anyone to trade ERC-20 tokens without the need for a centralized intermediary. This open access democratizes trading and increases liquidity in the market.

- Automated Market Maker (AMM): Uniswap’s AMM model replaces traditional order books with liquidity pools, enabling seamless and efficient token swaps. Liquidity providers deposit tokens into pools and earn a share of the trading fees.

- Community Governance: Uniswap’s governance is decentralized, with UNI token holders having the power to propose and vote on protocol changes. This community-driven approach ensures that the platform evolves according to the needs and preferences of its users.

Enhanced Liquidity

- Liquidity Pools: Uniswap incentivizes users to provide liquidity by offering them a share of the transaction fees. This model ensures that there is always liquidity available for trading.

- Yield Farming: By providing liquidity, users can participate in yield farming opportunities, earning additional rewards on top of trading fees.

Innovation and Integration

- Flash Swaps: Uniswap introduced flash swaps, allowing users to withdraw tokens from a pool and use them elsewhere, provided they return the tokens or their equivalent value by the end of the transaction.

- Price Oracles: Uniswap’s time-weighted average price (TWAP) oracles provide reliable price data, which can be used by other DeFi applications to enhance their functionalities.

Connecting with Other DeFi Applications

Uniswap’s integration with other DeFi applications expands its utility and creates a more interconnected financial ecosystem:

Interoperability

- Wallet Integrations: Uniswap seamlessly integrates with popular Ethereum wallets like MetaMask, Trust Wallet, and Coinbase Wallet, allowing users to trade directly from their wallets.

- DeFi Aggregators: Platforms like 1inch and Matcha aggregate liquidity from multiple DEXs, including Uniswap, to provide users with the best possible trading rates and reduced slippage.

- Lending and Borrowing: DeFi protocols such as Aave and Compound allow users to supply Uniswap LP tokens as collateral for loans, enabling them to earn interest while still participating in liquidity pools.

Yield Optimization

- Yield Farming Platforms: Services like Yearn Finance optimize yield farming by automatically shifting funds between different liquidity pools and DeFi protocols to maximize returns.

- Staking: Some DeFi platforms allow users to stake their Uniswap LP tokens to earn additional rewards, increasing the potential earnings from providing liquidity.

Cross-Chain Solutions

- Bridges and Cross-Chain Swaps: Projects like Polkadot and Cosmos are developing solutions to enable cross-chain swaps, allowing Uniswap users to trade tokens across different blockchain networks seamlessly.

- Interoperable Protocols: Integrations with interoperable DeFi protocols enhance Uniswap’s functionality and accessibility, making it a hub for cross-chain DeFi activities.

Future Developments

Uniswap is continuously evolving, with several planned features aimed at improving the platform’s functionality, user experience, and integration within the broader DeFi ecosystem. Additionally, strong community and developer support play a crucial role in driving these developments.

Planned Features for Uniswap

Uniswap has a robust roadmap that includes various upgrades and new features to enhance its capabilities:

Layer 2 Scaling Solutions

- Optimistic Rollups: Uniswap is exploring the implementation of Layer 2 solutions like Optimistic Rollups to significantly reduce gas fees and increase transaction throughput. This will make trading more efficient and accessible, especially during periods of high network congestion.

- Arbitrum: Integration with Arbitrum, a Layer 2 scaling solution, is aimed at providing faster and cheaper transactions, improving the overall user experience.

Improved Governance Mechanisms

- Governance Upgrades: Enhancements to the governance process, such as improved voting mechanisms and more transparent proposal evaluations, are planned to ensure that community decisions are effectively implemented.

- Delegated Voting: Introduction of delegated voting features, allowing UNI holders to delegate their voting power to trusted community members, making it easier for users to participate in governance.

Enhanced User Interface

- UI/UX Improvements: Continuous improvements to the user interface and user experience, making it more intuitive and user-friendly. This includes better analytics, more detailed transaction histories, and streamlined navigation.

- Mobile Optimization: Further optimization for mobile devices to ensure a seamless trading experience on smartphones and tablets.

New Financial Instruments

- Derivatives and Options: Development of new financial instruments such as derivatives and options trading on Uniswap, providing users with more diverse investment opportunities.

- Synthetic Assets: Integration of synthetic assets, allowing users to trade on the value of real-world assets directly on Uniswap.

Advanced Trading Features

- Limit Orders: Introduction of limit orders, enabling users to set specific prices at which they want to buy or sell tokens, enhancing trading flexibility and control.

- Automated Strategies: Tools for automated trading strategies, such as stop-loss and take-profit orders, to help users manage their portfolios more effectively.

Community and Developer Support

Uniswap’s growth and innovation are driven by strong community engagement and extensive developer support:

Community Channels

- Forums and Social Media: Uniswap maintains active community forums, a Discord server, and a subreddit where users can discuss developments, share trading strategies, and seek support.

- Regular Updates: The Uniswap team provides regular updates on development progress, new features, and important announcements through their official blog, Twitter, and other social media channels.

Developer Resources

- Comprehensive Documentation: Uniswap offers extensive documentation (docs.uniswap.org) that covers everything from getting started to advanced development topics. This includes API references, smart contract details, and integration guides.

- Open Source Code: The Uniswap protocol is open source and available on GitHub (github.com/Uniswap). Developers can review the code, contribute to its improvement, and create their own projects based on Uniswap’s technology.

- Grants Program: The Uniswap Grants Program provides funding and support to developers working on projects that enhance the Uniswap ecosystem. This includes tooling, infrastructure, and educational resources.

- Hackathons and Events: Uniswap regularly sponsors and participates in hackathons and other developer events to foster innovation and collaboration within the DeFi community.