Yes, Uniswap is a DeFi app that enables decentralized trading of Ethereum-based tokens using an automated market maker model.

Understanding DeFi Applications

Decentralized Finance (DeFi) represents a revolutionary shift in the financial industry, leveraging blockchain technology to offer decentralized financial services. This section explores what DeFi is and the key features of DeFi applications.

What is DeFi?

- Decentralized Finance Defined:

- DeFi refers to financial systems built on blockchain technology that operate without intermediaries such as banks and financial institutions.

- It utilizes smart contracts on blockchain platforms like Ethereum to facilitate financial transactions and services.

- Principles of DeFi:

- Openness: DeFi platforms are open to anyone with an internet connection, providing financial services to the unbanked and underbanked.

- Transparency: All transactions are recorded on a public blockchain, ensuring transparency and accountability.

- Interoperability: DeFi applications are designed to work together, allowing users to integrate multiple services and create complex financial products.

- Popular DeFi Services:

- Lending and Borrowing: Platforms like Aave and Compound enable users to lend and borrow assets without a centralized authority.

- Decentralized Exchanges (DEXs): Exchanges like Uniswap and SushiSwap facilitate peer-to-peer trading of cryptocurrencies.

- Stablecoins: Cryptocurrencies like DAI are pegged to stable assets to reduce volatility.

Key Features of DeFi Apps

- Smart Contracts:

- Automated Agreements: Smart contracts are self-executing contracts with the terms directly written into code. They automatically execute transactions when predefined conditions are met.

- Trustless Transactions: Users do not need to trust a central authority; instead, they rely on the underlying code and blockchain.

- Non-Custodial:

- User Control: DeFi apps are non-custodial, meaning users retain control of their private keys and funds at all times. There is no need to trust a third party with assets.

- Security: This reduces the risk of hacking and theft associated with centralized custody of funds.

- Permissionless:

- Open Access: Anyone can access DeFi services without needing approval or verification from a central authority.

- Innovation: Developers can create and deploy DeFi applications without seeking permission, fostering innovation and rapid development.

- Interoperability:

- Composable Ecosystem: DeFi apps are designed to work together seamlessly, allowing users to stack services and create complex financial products (often referred to as “money legos”).

- Integration: Users can integrate lending, borrowing, trading, and other services to optimize their financial strategies.

- Transparency:

- Public Ledger: All transactions and smart contract operations are recorded on a public blockchain, providing complete transparency and auditability.

- Community Governance: Many DeFi platforms are governed by their communities, often through governance tokens, ensuring that users have a say in the platform’s development and policies.

Overview of Uniswap

Uniswap is a pioneering decentralized exchange (DEX) in the decentralized finance (DeFi) ecosystem, facilitating peer-to-peer cryptocurrency trading without the need for a central authority. This section provides an introduction to Uniswap and its core functions.

Introduction to Uniswap

- What is Uniswap?

- Uniswap is a decentralized exchange protocol built on the Ethereum blockchain that allows users to swap ERC-20 tokens directly from their wallets.

- Founded by Hayden Adams in 2018, Uniswap leverages an automated market maker (AMM) system instead of traditional order books.

- Key Features:

- Decentralization: Uniswap operates without intermediaries, providing a trustless and permissionless trading environment.

- Liquidity Pools: Instead of matching buyers with sellers, Uniswap uses liquidity pools funded by users to facilitate trades.

- Open Source: The Uniswap protocol is open source, enabling developers to contribute to its codebase and build upon its infrastructure.

Core Functions of Uniswap

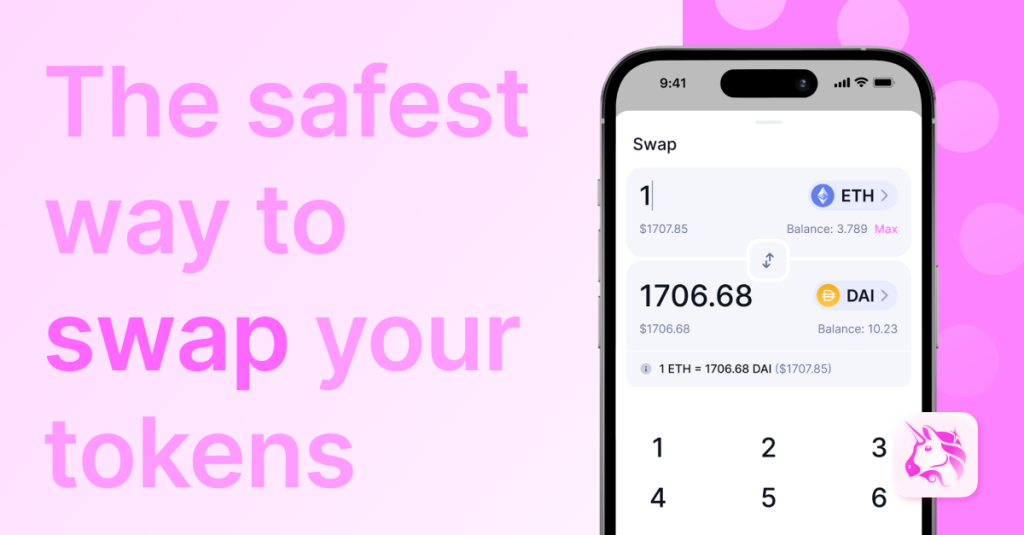

- Token Swapping:

- Seamless Trading: Users can swap between a vast array of ERC-20 tokens directly from their cryptocurrency wallets.

- Automated Market Maker (AMM): Uniswap uses smart contracts to determine token prices based on the ratio of tokens in liquidity pools, ensuring continuous liquidity.

- User-Friendly Interface: The platform’s intuitive interface makes it easy for both beginners and experienced traders to execute trades quickly.

- Providing Liquidity:

- Liquidity Pools: Users can provide liquidity by depositing an equal value of two tokens into a pool, earning a portion of the trading fees generated by that pool.

- Incentives: Liquidity providers (LPs) earn fees proportional to their share of the pool, incentivizing them to add liquidity and maintain pool balances.

- Passive Income: By providing liquidity, users can earn passive income through the fees collected from trades within their pools.

- Governance:

- UNI Token: Uniswap’s governance is driven by the UNI token, which allows holders to vote on protocol upgrades, changes, and other important decisions.

- Decentralized Control: The community-driven governance model ensures that the platform evolves according to the needs and preferences of its users.

- Security Measures:

- Non-Custodial: Users retain control of their private keys and funds, reducing the risk associated with centralized exchanges.

- Transparent Transactions: All transactions and operations are executed on the Ethereum blockchain, providing transparency and verifiability.

- Audits and Updates: Uniswap’s smart contracts are regularly audited to ensure security and reliability, with updates rolled out to address vulnerabilities and improve functionality.

How Uniswap Fits into DeFi

Uniswap plays a pivotal role in the decentralized finance (DeFi) ecosystem by providing a trustless, permissionless platform for trading cryptocurrencies. This section examines how Uniswap embodies the principles of decentralization and utilizes the Automated Market Maker (AMM) model.

Decentralization Aspect

- Trustless Transactions:

- Uniswap operates without intermediaries, allowing users to trade directly with one another. This trustless environment eliminates the need for a central authority or third-party oversight.

- Users maintain control of their funds at all times, only interacting with smart contracts to execute trades.

- Permissionless Access:

- Anyone with an Ethereum wallet can access and use Uniswap. There are no registration requirements or KYC (Know Your Customer) procedures, promoting financial inclusion and privacy.

- This open access ensures that users from all over the world can participate in DeFi without barriers.

- Community Governance:

- Uniswap is governed by its community through the UNI token. Token holders can propose and vote on changes to the protocol, ensuring that the platform evolves according to the collective interests of its users.

- This decentralized governance model democratizes decision-making and encourages active participation from the community.

- Transparency:

- All transactions and operations on Uniswap are recorded on the Ethereum blockchain, providing complete transparency. Users can verify trades, liquidity pool balances, and smart contract operations in real-time.

- This transparency builds trust and accountability, as all actions are publicly auditable.

Automated Market Maker (AMM) Model

- Liquidity Pools:

- Instead of traditional order books, Uniswap uses liquidity pools where users deposit pairs of tokens. These pools provide the necessary liquidity for trades to occur.

- Liquidity providers earn a portion of the trading fees proportional to their contribution to the pool, incentivizing them to add liquidity.

- Price Determination:

- The AMM model determines token prices based on the ratio of tokens in the liquidity pool. As trades occur, the ratios adjust, which in turn updates the prices.

- This mechanism, known as the Constant Product Market Maker formula, ensures continuous liquidity and allows for efficient trading.

- User Participation:

- Anyone can become a liquidity provider (LP) by depositing tokens into a pool. LPs contribute to the pool’s depth and stability, earning fees from trades executed within the pool.

- This model decentralizes the liquidity provision process, allowing users to collectively contribute to and benefit from the platform’s liquidity.

- Lower Barriers to Entry:

- The AMM model lowers the barriers to entry for trading and liquidity provision. Users do not need to be matched with buyers or sellers, nor do they need to understand complex market dynamics.

- This simplicity makes it easier for individuals to participate in DeFi, driving wider adoption and engagement.

Benefits of Using Uniswap

Uniswap offers a range of benefits that make it an attractive choice for users looking to trade cryptocurrencies and participate in decentralized finance (DeFi). This section highlights the key advantages of using Uniswap, focusing on security and control, as well as accessibility and inclusion.

Security and Control

- Non-Custodial Nature:

- Uniswap is a non-custodial platform, meaning users retain full control over their funds. Unlike centralized exchanges, Uniswap does not hold users’ assets, significantly reducing the risk of hacks and theft.

- Users interact directly with smart contracts to execute trades, ensuring that their private keys and funds remain secure.

- Smart Contract Security:

- Uniswap’s smart contracts are open-source and regularly audited by third-party security firms. These audits help identify and mitigate vulnerabilities, ensuring the platform’s robustness and reliability.

- The transparency of smart contracts allows users to verify the code and understand how their transactions are processed, fostering trust in the platform.

- Decentralized Governance:

- The UNI token empowers users to participate in the governance of Uniswap. Token holders can propose and vote on protocol changes, ensuring that the platform evolves according to the community’s needs and preferences.

- This decentralized decision-making process enhances security by distributing power and reducing the risk of centralized control.

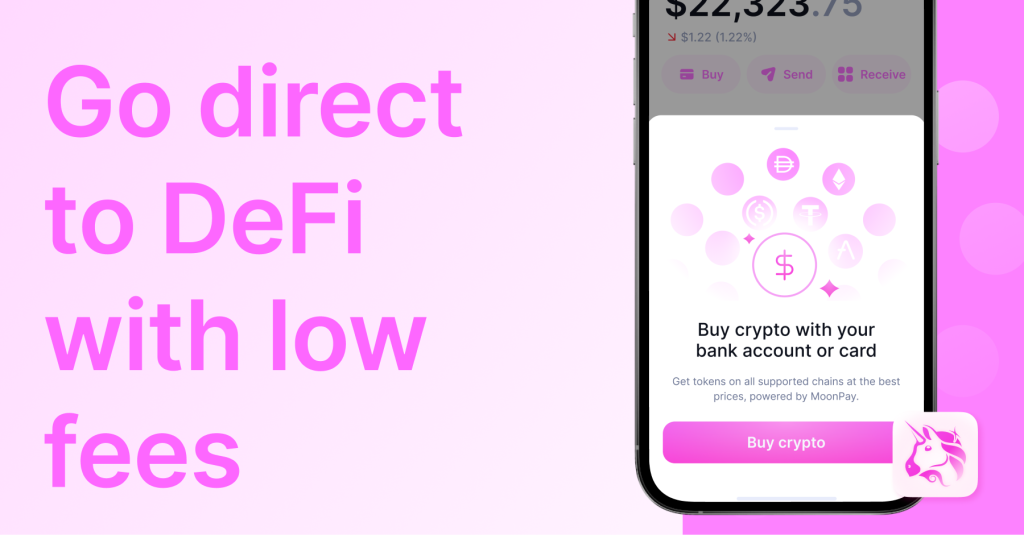

Accessibility and Inclusion

- Permissionless Access:

- Uniswap is open to anyone with an internet connection and a compatible Ethereum wallet. There are no registration requirements or KYC (Know Your Customer) procedures, making it accessible to a global audience.

- This inclusivity ensures that individuals from all regions, including those with limited access to traditional financial services, can participate in DeFi.

- User-Friendly Interface:

- Uniswap’s intuitive interface makes it easy for both beginners and experienced users to trade cryptocurrencies. The straightforward design simplifies the trading process, enabling users to execute trades with minimal friction.

- The platform provides real-time data on prices, liquidity, and transaction costs, helping users make informed decisions.

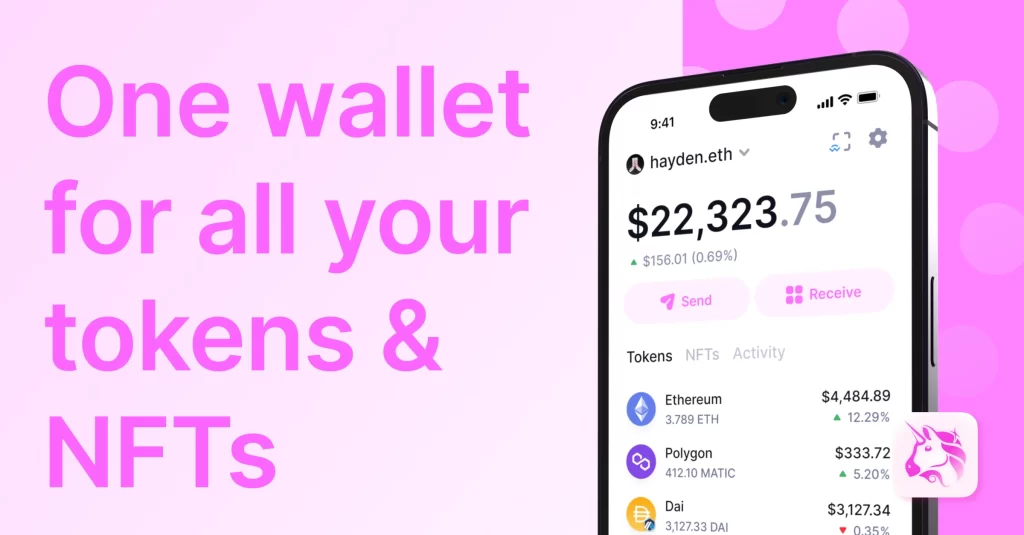

- Wide Range of Supported Tokens:

- Uniswap supports a vast array of ERC-20 tokens, allowing users to trade a diverse range of assets. This extensive token support provides users with numerous options for trading and investment.

- The ability to list new tokens without permission promotes innovation and inclusivity, giving projects of all sizes access to liquidity and exposure.

- Community Support and Resources:

- Uniswap benefits from a vibrant community that actively contributes to its development and improvement. Users can access a wealth of educational resources, including tutorials, guides, and forums, to enhance their understanding of the platform.

- Community-driven initiatives and support channels provide users with assistance and guidance, fostering a collaborative and inclusive environment.

Comparing Uniswap to Other DeFi Apps

Uniswap stands out among decentralized finance (DeFi) applications due to its unique features, yet it also shares similarities with other platforms in the DeFi ecosystem. This section highlights the distinctive aspects of Uniswap and its commonalities with other DeFi platforms.

Unique Features of Uniswap

- Automated Market Maker (AMM) Model:

- Uniswap pioneered the AMM model, which uses liquidity pools instead of traditional order books. This model allows for continuous trading and provides liquidity through user-contributed pools.

- The Constant Product Market Maker formula ensures that token prices are determined by the ratio of tokens in the pool, maintaining liquidity even in volatile markets.

- UNI Governance Token:

- The UNI token is a key feature of Uniswap, enabling decentralized governance. UNI holders can propose and vote on changes to the protocol, ensuring that the platform evolves based on community consensus.

- Governance proposals can include adjustments to fee structures, liquidity incentives, and protocol upgrades, providing a democratic approach to platform development.

- Permissionless Listing:

- Uniswap allows for the permissionless listing of ERC-20 tokens, meaning any token can be added to the platform without approval from a central authority.

- This openness promotes innovation and supports the launch and trading of a wide variety of tokens, including those from new and emerging projects.

- Simplicity and User Experience:

- Uniswap’s user interface is designed for ease of use, making it accessible to both novice and experienced traders. The platform provides straightforward options for swapping tokens, adding liquidity, and managing funds.

- Real-time data and transparent transaction details enhance the user experience by providing clarity and confidence in trading activities.

Similarities with Other DeFi Platforms

- Decentralization:

- Like other DeFi platforms, Uniswap operates in a decentralized manner, allowing users to trade and interact with financial services without relying on intermediaries.

- Decentralization enhances security, privacy, and censorship resistance, core principles shared across the DeFi ecosystem.

- Smart Contract Utilization:

- Uniswap, along with other DeFi apps, leverages smart contracts to automate processes and enforce rules without the need for a central authority.

- These smart contracts are open-source and subject to community scrutiny, ensuring transparency and trustworthiness.

- Yield Farming and Liquidity Mining:

- Uniswap and many other DeFi platforms offer yield farming and liquidity mining opportunities, where users can earn rewards for providing liquidity or participating in other network activities.

- These incentives encourage user participation and contribute to the growth and stability of the DeFi ecosystem.

- Interoperability:

- Uniswap, like other DeFi platforms, is designed to be interoperable with other protocols and services within the Ethereum ecosystem. Users can integrate multiple DeFi applications to create complex financial strategies.

- This composability allows for seamless interactions between different DeFi services, enhancing the overall functionality and flexibility of the ecosystem.

- Transparency and Trust:

- Transparency is a hallmark of DeFi platforms, including Uniswap. All transactions and operations are publicly recorded on the blockchain, allowing for full auditability and reducing the risk of fraud.

- Trust is built through decentralized governance, open-source code, and community participation, features that are common across DeFi applications.

Risks and Considerations

While Uniswap offers numerous advantages, it also comes with potential risks that users should be aware of. This section outlines the primary risks associated with using Uniswap and strategies for mitigating these risks in the DeFi space.

Potential Risks in Using Uniswap

- Smart Contract Vulnerabilities:

- Risk: Despite rigorous audits, smart contracts can still have vulnerabilities that hackers might exploit. These vulnerabilities can lead to loss of funds.

- Example: Past incidents in DeFi have shown that even well-audited contracts can be exploited, leading to significant financial losses.

- Impermanent Loss:

- Risk: Liquidity providers (LPs) might experience impermanent loss when the value of deposited tokens changes significantly compared to when they were added to the pool.

- Example: If the price of one token in a pair rises sharply, the LP might end up with less of the more valuable token and more of the less valuable one, resulting in a potential loss.

- High Gas Fees:

- Risk: Ethereum network congestion can lead to high gas fees, making transactions expensive, especially for small trades or frequent transactions.

- Example: During periods of high network activity, gas fees can exceed the value of the trade itself, making it economically unfeasible.

- Phishing and Scams:

- Risk: Users might fall victim to phishing attacks or scam websites that mimic the official Uniswap interface to steal funds.

- Example: Fake websites and links can trick users into entering their private keys or transferring funds to malicious addresses.

- Regulatory Risks:

- Risk: The regulatory environment for cryptocurrencies and DeFi is still evolving. Future regulations could impact the use and legality of Uniswap in certain jurisdictions.

- Example: Regulatory crackdowns or new laws could restrict access to DeFi platforms or impose new compliance requirements.

Mitigating Risks in DeFi

- Due Diligence and Audits:

- Action: Always use platforms that have undergone thorough security audits and have a strong reputation in the community.

- Strategy: Regularly check for updates and reviews on the security of the platform. Stay informed about any vulnerabilities and the measures taken to address them.

- Managing Impermanent Loss:

- Action: Understand the concept of impermanent loss and monitor the performance of your liquidity pools. Use tools and calculators to estimate potential losses.

- Strategy: Diversify your liquidity provision across multiple pools and consider impermanent loss protection strategies, such as using stablecoin pairs.

- Monitoring Gas Fees:

- Action: Keep an eye on Ethereum gas fees and plan transactions during periods of lower network congestion.

- Strategy: Use gas fee tracking tools and set gas price alerts. Consider Layer 2 solutions or other DeFi platforms with lower transaction costs.

- Security Practices:

- Action: Use only the official Uniswap website and trusted links. Enable two-factor authentication (2FA) on your wallet and related accounts.

- Strategy: Bookmark the official Uniswap URL and avoid clicking on links from unknown sources. Use hardware wallets for added security.

- Regulatory Awareness:

- Action: Stay informed about the regulatory developments in your jurisdiction concerning DeFi and cryptocurrency usage.

- Strategy: Follow reputable news sources and legal advisories. Consider the legal implications of your activities and consult with a legal professional if necessary.

Future of Uniswap in the DeFi Space

Uniswap continues to evolve and expand its influence within the decentralized finance (DeFi) ecosystem. This section explores the future prospects of Uniswap, highlighting upcoming features and updates, as well as its potential impact on the broader DeFi landscape.

Upcoming Features and Updates

- Uniswap V4:

- Enhanced Protocol: Uniswap V4 is expected to bring significant improvements in terms of efficiency, scalability, and user experience. New features might include advanced order types, enhanced liquidity management tools, and more efficient gas usage.

- Layer 2 Integration: Continued integration with Layer 2 solutions like Optimism and Arbitrum to reduce transaction costs and improve scalability. This will make Uniswap more accessible to a broader user base by lowering the barrier to entry.

- Governance Enhancements:

- Decentralized Governance: Strengthening the governance framework to enable more decentralized and inclusive decision-making processes. This could involve new voting mechanisms and enhanced community engagement.

- Proposal Process: Streamlining the proposal process to make it easier for UNI token holders to submit and vote on changes, fostering a more dynamic and responsive governance system.

- Expanded Token Support:

- Cross-Chain Compatibility: Development of cross-chain functionality to support tokens from other blockchains, not just Ethereum. This will broaden Uniswap’s reach and usability across different blockchain ecosystems.

- New Asset Types: Integration of more diverse asset types, including synthetic assets, NFTs, and other innovative financial instruments, to enhance trading options and liquidity.

- User Experience Improvements:

- Interface Upgrades: Ongoing enhancements to the user interface and user experience, making the platform more intuitive and user-friendly for both new and experienced traders.

- Educational Resources: Expansion of educational materials and resources to help users better understand how to use the platform, manage risks, and maximize their DeFi opportunities.

Impact on the DeFi Ecosystem

- Increased Liquidity:

- Global Liquidity Pools: As Uniswap integrates more tokens and cross-chain capabilities, it will attract more liquidity from various sources, making the DeFi ecosystem more robust and liquid.

- Institutional Participation: Enhanced features and security measures could attract institutional investors, bringing more significant capital inflows and stability to the DeFi space.

- Innovation and Competition:

- Catalyst for Innovation: Uniswap’s continuous improvements and new features will push other DeFi platforms to innovate, fostering a competitive environment that benefits users with better services and lower costs.

- DeFi Interoperability: Uniswap’s developments in cross-chain compatibility will promote greater interoperability within the DeFi ecosystem, enabling seamless integration and interaction between different platforms.

- Mainstream Adoption:

- User Growth: Lower transaction costs and improved user experience will attract more users to DeFi, accelerating mainstream adoption of decentralized financial services.

- Regulatory Influence: As Uniswap grows, it will likely play a more significant role in shaping regulatory discussions around DeFi, advocating for policies that support innovation while ensuring user protection.

- Economic Inclusion:

- Financial Access: By lowering barriers to entry and providing decentralized financial services globally, Uniswap can contribute to greater economic inclusion, offering financial tools to those without access to traditional banking systems.

- Empowering Communities: Decentralized governance and community-driven initiatives can empower users to have a direct impact on the development and direction of financial services, fostering a sense of ownership and participation.