Yes, you can still use Uniswap v2, but consider the benefits of upgrading to Uniswap v3 for improved features.

Understanding Uniswap v2 and Its Functionality

What is Uniswap v2?

Uniswap v2 is a decentralized exchange protocol built on the Ethereum blockchain. It allows users to trade ERC-20 tokens directly from their wallets without the need for a traditional centralized exchange. Launched in May 2020, Uniswap v2 introduced several improvements over its predecessor, including more efficient token swaps and increased liquidity.

- Decentralized Protocol: Uniswap v2 operates without a central authority, relying on smart contracts to facilitate trades.

- ERC-20 Tokens: The platform supports a wide range of ERC-20 tokens, enabling diverse trading pairs.

- Liquidity Pools: Users can provide liquidity to various pools, earning fees in return.

How Does Uniswap v2 Work?

Uniswap v2 uses an automated market maker (AMM) model, which allows users to trade tokens using liquidity pools rather than a traditional order book. This model ensures constant liquidity and simplifies the trading process.

- Automated Market Maker (AMM): Instead of matching buy and sell orders, Uniswap v2 uses liquidity pools where users can swap tokens.

- Liquidity Providers: Users who contribute tokens to liquidity pools earn a share of the trading fees generated by the pool.

- Constant Product Formula: The pricing of tokens in Uniswap v2 is determined by the constant product formula, which maintains a balance between the token reserves in the pool.

- Impermanent Loss: Liquidity providers should be aware of the concept of impermanent loss, which occurs when the value of their deposited tokens changes relative to the pool’s overall value.

Differences Between Uniswap v2 and v3

Key Features of Uniswap v2

Uniswap v2 introduced several key features that made it a popular choice for decentralized trading on the Ethereum blockchain.

- ERC-20 to ERC-20 Pairs: Unlike its predecessor, Uniswap v2 allows for direct ERC-20 token swaps, eliminating the need for intermediary ETH conversions.

- Price Oracles: Uniswap v2 includes a built-in price oracle that aggregates historical price data, providing more reliable pricing for DeFi applications.

- Flash Swaps: This feature allows users to withdraw up to the entire reserve of any ERC-20 token on Uniswap and use it freely, provided they return the equivalent value by the end of the transaction.

- Improved Efficiency: Uniswap v2’s design optimizes gas fees and transaction speed, making trading and liquidity provision more cost-effective.

Enhancements in Uniswap v3

Uniswap v3 builds on the foundation of Uniswap v2, introducing significant enhancements to improve trading efficiency and flexibility.

- Concentrated Liquidity: Uniswap v3 allows liquidity providers to concentrate their capital within specific price ranges, increasing the efficiency of liquidity use and potentially earning higher fees.

- Multiple Fee Tiers: Uniswap v3 offers multiple fee tiers (0.05%, 0.30%, and 1.00%) to accommodate different types of trading pairs, allowing users to choose the fee tier that best suits their risk and return preferences.

- Range Orders: Liquidity providers can place limit orders by setting a price range within which they want to provide liquidity, making the system more dynamic and responsive to market conditions.

- Flexible Liquidity Provision: Uniswap v3 allows liquidity to be added and removed more flexibly, enabling providers to manage their positions more actively based on market trends.

Benefits of Using Uniswap v2

User Experience

Uniswap v2 offers a user-friendly interface that simplifies the process of trading and providing liquidity.

- Intuitive Interface: The platform is designed with simplicity in mind, making it easy for both new and experienced users to navigate and execute trades.

- No Account Required: Users can trade directly from their wallets without the need for account creation or verification, preserving privacy and reducing barriers to entry.

- Direct Wallet Integration: Uniswap v2 integrates seamlessly with popular Ethereum wallets such as MetaMask, Trust Wallet, and others, allowing users to connect their wallets and start trading immediately.

Transaction Fees

Uniswap v2 is known for its relatively low and predictable transaction fees compared to traditional centralized exchanges.

- Lower Fees: By leveraging the Ethereum blockchain, Uniswap v2 avoids many of the overhead costs associated with centralized exchanges, resulting in lower fees for users.

- Transparent Fee Structure: The fee structure is straightforward, with a 0.30% fee on each trade that is distributed to liquidity providers, ensuring users know exactly what they are paying.

- Gas Optimization: Although gas fees on the Ethereum network can fluctuate, Uniswap v2’s smart contract design aims to minimize gas costs, making transactions more affordable for users.

Liquidity Pools

Uniswap v2’s liquidity pool model offers significant benefits for both traders and liquidity providers.

- Decentralized Liquidity: Anyone can become a liquidity provider by depositing an equal value of two tokens into a pool, democratizing access to liquidity provision.

- Earning Potential: Liquidity providers earn a share of the trading fees generated by the pool in proportion to their contribution, providing a passive income opportunity.

- Reduced Slippage: The automated market maker (AMM) model helps maintain consistent liquidity, reducing slippage and improving trade execution even for larger transactions.

- Community-Driven Pools: New liquidity pools can be created for any ERC-20 token pair, fostering a diverse and growing ecosystem of trading pairs and opportunities.

Potential Drawbacks of Sticking with Uniswap v2

Lower Liquidity

Using Uniswap v2 may present challenges related to liquidity compared to newer versions.

- Reduced Liquidity: As more users and liquidity providers migrate to Uniswap v3 for its advanced features, the liquidity available in Uniswap v2 pools may decrease, leading to higher slippage and less favorable trading conditions.

- Increased Competition: The introduction of concentrated liquidity in Uniswap v3 allows providers to allocate their capital more efficiently, potentially drawing liquidity away from Uniswap v2 and reducing its overall liquidity depth.

- Impact on Large Trades: Lower liquidity can particularly affect large trades, causing significant price impact and making it more challenging to execute sizable transactions without incurring substantial costs.

Fewer Updates

Uniswap v2 may receive fewer updates and improvements compared to its successor.

- Lack of New Features: Uniswap Labs is likely to focus on enhancing Uniswap v3, meaning Uniswap v2 will not benefit from the latest features and improvements, which could limit its functionality and user experience over time.

- Security Vulnerabilities: While Uniswap v2 is secure, the lack of ongoing updates and maintenance may leave it more susceptible to emerging security threats and vulnerabilities compared to actively maintained platforms.

- Innovation Gap: With the DeFi landscape rapidly evolving, sticking with Uniswap v2 might mean missing out on innovative developments and enhancements that improve trading efficiency, user experience, and security.

How to Use Uniswap v2: A Step-by-Step Guide

Setting Up Your Wallet

To start using Uniswap v2, you need a compatible Ethereum wallet.

- Choose a Wallet: Select a wallet that supports Ethereum and ERC-20 tokens, such as MetaMask, Trust Wallet, or Coinbase Wallet.

- Install and Set Up: Follow the instructions to install your chosen wallet. For MetaMask, this involves downloading the browser extension and creating a new wallet with a secure password.

- Fund Your Wallet: Transfer ETH to your wallet to cover transaction fees and provide the necessary funds for trading or liquidity provision.

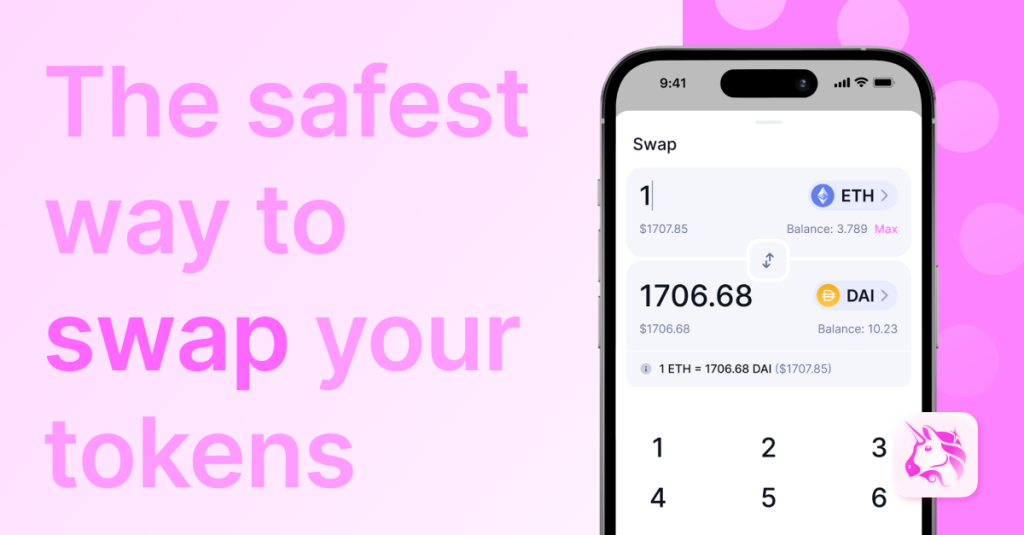

Trading Tokens

Trading on Uniswap v2 is straightforward and can be done directly from your wallet.

- Connect Your Wallet: Visit the Uniswap v2 interface and connect your Ethereum wallet by clicking on the “Connect to a wallet” button.

- Select Tokens: Choose the tokens you want to trade from the dropdown menus. Enter the amount of the token you wish to swap.

- Review Trade Details: Uniswap v2 will display the estimated amount of the token you will receive, the price impact, and the transaction fee. Review these details carefully.

- Execute the Trade: Click the “Swap” button, confirm the transaction in your wallet, and wait for the transaction to be processed on the Ethereum network.

Providing Liquidity

Providing liquidity allows you to earn a share of the trading fees generated by the pool.

- Select a Pool: Choose a token pair for which you want to provide liquidity. You can browse existing pools or create a new one if your desired pair is not listed.

- Deposit Tokens: To add liquidity, you need to deposit an equal value of both tokens in the pair. For example, if you are adding liquidity to an ETH/DAI pool, you need to deposit an equivalent value of ETH and DAI.

- Approve Tokens: You may need to approve the tokens in your wallet before depositing them into the liquidity pool. This step ensures the Uniswap smart contract can access your tokens.

- Add Liquidity: Enter the amount of each token you want to deposit, review the pool share you will receive, and confirm the transaction in your wallet.

- Monitor Your Position: Once your liquidity is added, you will start earning a share of the trading fees. You can monitor your position and withdraw your liquidity at any time by navigating to the “Pool” tab in the Uniswap interface.

Security and Safety Measures for Uniswap v2 Users

Wallet Protection

Ensuring the security of your wallet is crucial when using Uniswap v2.

- Use a Secure Wallet: Choose a reputable wallet with strong security features. Hardware wallets like Ledger or Trezor provide an extra layer of security compared to software wallets.

- Enable Two-Factor Authentication: If your wallet supports it, enable two-factor authentication (2FA) to add an additional security step when accessing your funds.

- Strong Passwords: Use complex, unique passwords for your wallet and any associated accounts. Avoid reusing passwords across multiple platforms.

- Backup Your Wallet: Store your wallet’s recovery phrase in a secure, offline location. Do not share this phrase with anyone or store it digitally where it can be accessed by hackers.

- Regular Updates: Keep your wallet software and any connected applications up to date to protect against known vulnerabilities.

Avoiding Common Scams

Awareness and vigilance can help you avoid common scams in the DeFi space.

- Verify URLs: Always ensure you are visiting the official Uniswap website (https://uniswap.org) and not a phishing site. Bookmark the official site to avoid mistyped URLs.

- Be Wary of Airdrop Scams: Be cautious of unsolicited airdrops or messages claiming you have won tokens. Scammers often use fake airdrops to trick users into revealing their private keys or recovery phrases.

- Double-Check Transactions: Before confirming any transaction, double-check the details, including the token addresses and amounts. Scammers can manipulate transactions to send funds to their addresses.

- Avoid Suspicious Links: Do not click on links from unknown or untrusted sources, especially in emails or social media messages. Scammers use these methods to direct users to phishing sites.

- Research Token Projects: Before trading or providing liquidity for a token, research the project to ensure it is legitimate. Look for verified information and community feedback.

Community and Support for Uniswap v2 Users

Available Resources

Uniswap v2 users have access to a wealth of resources to help them navigate the platform and stay informed.

- Official Documentation: The Uniswap documentation (docs.uniswap.org) provides comprehensive guides and FAQs on how to use the platform, covering everything from basic trading to advanced features.

- Tutorials and Guides: There are numerous tutorials and guides available online, including video walkthroughs and step-by-step articles, to help users understand how to trade, provide liquidity, and manage their assets on Uniswap v2.

- GitHub Repository: The Uniswap GitHub repository (github.com/Uniswap) offers access to the source code, developer resources, and technical documentation for those interested in the technical aspects of the protocol.

Forums and Community Support

The Uniswap community is active and supportive, offering various channels for users to seek help and share information.

- Uniswap Community Forum: The official Uniswap community forum (community.uniswap.org) is a great place to ask questions, share experiences, and get advice from other users and developers.

- Reddit: The Uniswap subreddit (reddit.com/r/UniSwap) is another valuable resource where users can discuss issues, share news, and find community-driven support.

- Discord: The Uniswap Discord server (discord.gg/Uniswap) provides real-time chat support, with dedicated channels for different topics, including general discussion, technical support, and developer questions.

- Twitter: Follow the official Uniswap Twitter account (@Uniswap) for the latest updates, announcements, and community news.