Yes, you need ETH to use Uniswap for gas fees required in all transactions on the Ethereum network.

Understanding Uniswap and Its Requirements

Uniswap is a decentralized exchange (DEX) platform that operates on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly without the need for a central authority. This guide will provide a detailed understanding of what Uniswap is and its key components.

What is Uniswap?

Uniswap is a protocol for automated token exchange on Ethereum. Unlike traditional exchanges, Uniswap does not require an order book or any centralized party to facilitate trading. Instead, it uses a model called automated market making (AMM), which enables users to trade directly from their wallets.

- Decentralized Exchange: Uniswap operates on a decentralized platform, meaning it doesn’t have a central authority controlling the transactions.

- Liquidity Pools: Users can provide liquidity to various pools on Uniswap, earning fees in return.

- ERC-20 Tokens: Uniswap supports the trading of any token that adheres to the ERC-20 standard.

- Non-Custodial: Users maintain control over their funds throughout the trading process, as Uniswap does not hold any assets.

Key Components of Uniswap

Uniswap comprises several essential components that enable its functionality and efficiency. Understanding these components is crucial for users who want to navigate the platform effectively.

Liquidity Pools

Liquidity pools are the backbone of Uniswap. They are pools of tokens locked in a smart contract that provide liquidity for trading pairs. Users who provide liquidity earn a portion of the trading fees.

- Functionality: Liquidity pools facilitate trades without needing a traditional order book.

- Incentives: Liquidity providers earn fees generated from trades within their pool.

Automated Market Maker (AMM)

Uniswap uses an AMM model, which determines the price of tokens using a mathematical formula. This model enables continuous liquidity regardless of trade size.

- Pricing Mechanism: The AMM uses a constant product formula (x * y = k) to ensure liquidity.

- Slippage: The model can lead to price slippage, especially for large trades.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate transactions on Uniswap, ensuring security and efficiency.

- Trustless Transactions: Smart contracts eliminate the need for intermediaries.

- Security: They enhance the security of transactions by minimizing the risk of human error or fraud.

Governance

Uniswap has a decentralized governance model that allows UNI token holders to propose and vote on changes to the protocol. This ensures that the community has a say in the platform’s development.

- Community Control: Governance tokens enable users to influence the platform’s future.

- Voting Power: The more UNI tokens a user holds, the greater their influence on governance decisions.

How Uniswap Works: A Basic Overview

Uniswap is a groundbreaking decentralized exchange (DEX) that allows users to trade Ethereum-based tokens directly from their wallets. Unlike traditional exchanges, Uniswap does not rely on an order book to facilitate trades. Instead, it employs an Automated Market Maker (AMM) model and leverages smart contracts on the Ethereum blockchain to ensure seamless, trustless transactions.

Automated Market Maker (AMM)

The AMM is a fundamental component of Uniswap, replacing the traditional order book system with a decentralized liquidity pool mechanism.

- Constant Product Formula: Uniswap’s AMM uses a constant product formula (x * y = k), where ‘x’ and ‘y’ represent the quantities of two tokens in a liquidity pool, and ‘k’ is a constant. This formula ensures that the product of the quantities of the two tokens remains constant, maintaining liquidity regardless of trade size.

- Price Determination: Token prices are automatically adjusted based on the ratio of tokens in the pool. If a user buys a large amount of one token, the price will increase due to the reduced supply of that token in the pool.

- Slippage: Larger trades may cause price slippage, where the expected price of a token deviates from the actual transaction price. This is a key consideration for users executing significant trades.

- Liquidity Providers (LPs): Anyone can become a liquidity provider by depositing an equivalent value of two tokens into a Uniswap pool. In return, LPs receive liquidity provider tokens, representing their share of the pool.

- Earnings: LPs earn a portion of the transaction fees generated by the pool. These fees are distributed proportionally based on the amount of liquidity provided.

- Impermanent Loss: LPs are exposed to impermanent loss, a temporary loss of funds that can occur when the price of the deposited tokens changes relative to each other. This risk is important to consider when providing liquidity.

Smart Contracts on Ethereum

Uniswap leverages smart contracts on the Ethereum blockchain to automate and secure transactions, eliminating the need for intermediaries.

- Trustless Transactions: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They facilitate trustless transactions, ensuring that trades occur as programmed without the need for a central authority.

- Security: The use of smart contracts enhances security by minimizing the risk of fraud and human error. Transactions are executed according to the contract’s code, which is publicly verifiable.

- Transparency: All transactions on Uniswap are transparent and can be verified on the Ethereum blockchain. This ensures accountability and trust within the ecosystem.

- Automation: Smart contracts automate the trading process, reducing the complexity and manual intervention required in traditional exchanges.

- Efficiency: The automation provided by smart contracts streamlines the trading process, enabling faster and more efficient transactions.

- Programmability: Developers can create and deploy custom smart contracts to interact with Uniswap, allowing for innovative applications and integrations.

Gas Fees: The Role of ETH in Uniswap Transactions

Gas fees play a crucial role in Uniswap transactions, as they are required for every operation performed on the Ethereum network. These fees are paid in ETH, making it an essential component for interacting with Uniswap.

What are Gas Fees?

Gas fees are transaction fees paid to compensate for the computational energy required to process and validate transactions on the Ethereum blockchain.

- Unit of Measurement: Gas is measured in “gwei,” a small denomination of ETH. Each operation on the Ethereum network requires a certain amount of gas to execute.

- Gas Price: The gas price is the amount of ETH a user is willing to pay per unit of gas. It is often denominated in gwei.

- Gas Limit: The gas limit is the maximum amount of gas a user is willing to spend on a transaction. It ensures that users do not overspend on gas fees.

- Types of Operations: Different operations on the Ethereum network require varying amounts of gas. Simple transactions like sending ETH may require less gas compared to more complex operations like executing smart contracts.

- Basic Transactions: Sending ETH from one address to another typically requires a small amount of gas.

- Smart Contract Interactions: Executing smart contracts, such as those used by Uniswap, generally requires more gas due to the complexity of the operations.

Importance of ETH for Gas Fees

ETH is the native cryptocurrency of the Ethereum blockchain and is required to pay gas fees. This makes holding ETH essential for using Uniswap and performing any transaction on the Ethereum network.

- Transaction Completion: Every transaction on Uniswap, whether it’s swapping tokens or providing liquidity, incurs a gas fee. Without sufficient ETH to cover these fees, transactions cannot be completed.

- Trade Execution: When swapping tokens on Uniswap, users must pay gas fees in ETH to execute the trade.

- Liquidity Provision: Adding or removing liquidity from Uniswap pools also requires gas fees paid in ETH.

- Network Congestion: Gas fees can vary significantly depending on network congestion. High demand for transaction processing can lead to higher gas prices.

- Peak Times: During peak network usage times, gas fees can increase substantially, making transactions more expensive.

- Fee Estimation: Users can estimate gas fees using various tools and adjust their gas price to prioritize the speed of their transactions.

- Impact on User Experience: High gas fees can affect the overall user experience on Uniswap, especially for smaller trades where the gas fees may constitute a significant portion of the transaction cost.

- Cost Efficiency: Users need to consider gas fees when planning their trades to ensure cost efficiency.

- Transaction Timing: Executing transactions during periods of lower network congestion can help minimize gas fees.

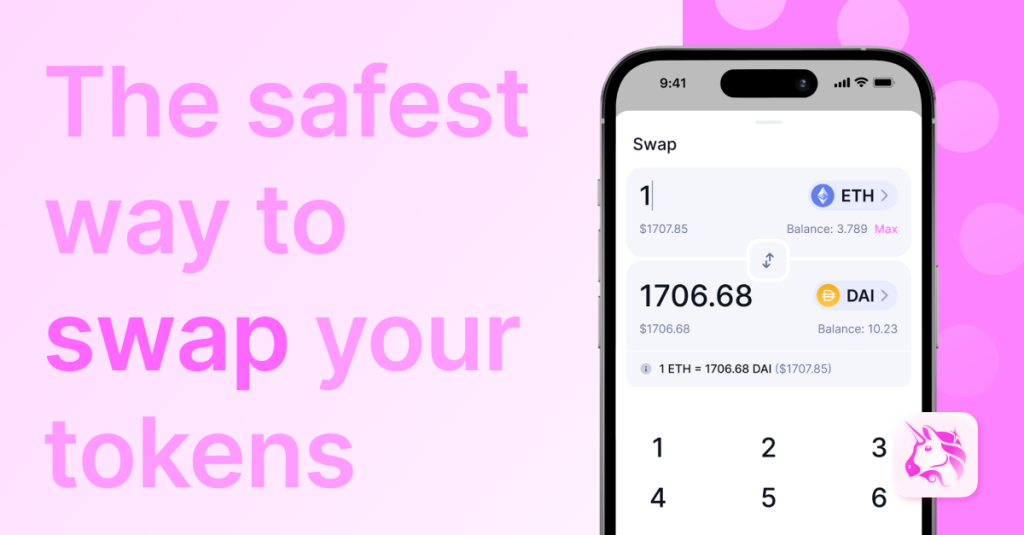

Swapping Tokens on Uniswap: A Step-by-Step Guide

Swapping tokens on Uniswap is a straightforward process that involves connecting your wallet and selecting the tokens you wish to trade. This guide will walk you through each step to ensure a smooth transaction.

Connecting Your Wallet

To start using Uniswap, you need to connect a compatible cryptocurrency wallet.

- Choosing a Wallet: Select a wallet that supports Ethereum and ERC-20 tokens, such as MetaMask, Trust Wallet, or Coinbase Wallet.

- MetaMask: A popular browser extension wallet that allows easy interaction with decentralized applications (dApps) like Uniswap.

- Trust Wallet: A mobile wallet that provides a user-friendly interface for managing Ethereum-based tokens.

- Coinbase Wallet: A wallet app from Coinbase that integrates with Uniswap for seamless token swaps.

- Connecting the Wallet: Navigate to the Uniswap website and click on the “Connect Wallet” button.

- Authorization: Grant the necessary permissions for Uniswap to interact with your wallet.

- Security: Ensure you are on the official Uniswap website to avoid phishing scams and protect your private keys.

Selecting and Swapping Tokens

Once your wallet is connected, you can proceed with selecting and swapping tokens.

- Choosing Tokens: Select the tokens you wish to swap from the dropdown menus.

- Input Token: Choose the token you want to swap from. This is typically the token you hold in your wallet.

- Output Token: Choose the token you want to receive. Uniswap supports a wide range of ERC-20 tokens.

- Entering the Amount: Specify the amount of the input token you want to trade.

- Estimated Output: Uniswap will display the estimated amount of the output token you will receive, based on current exchange rates and liquidity.

- Slippage Tolerance: Set your slippage tolerance, which is the acceptable difference between the expected and actual transaction price. This helps prevent failed transactions due to price fluctuations.

- Reviewing the Trade: Before finalizing the swap, review the transaction details.

- Transaction Fees: Check the gas fees required for the transaction and ensure you have enough ETH in your wallet to cover them.

- Price Impact: Consider the price impact of your trade, which is the difference between the market price and the execution price caused by your transaction.

- Confirming the Swap: Click the “Swap” button and confirm the transaction in your wallet.

- Transaction Confirmation: Wait for the transaction to be confirmed on the Ethereum blockchain. This process may take a few minutes depending on network congestion.

- Receipt: Once confirmed, you will receive a transaction receipt, and the swapped tokens will appear in your wallet.

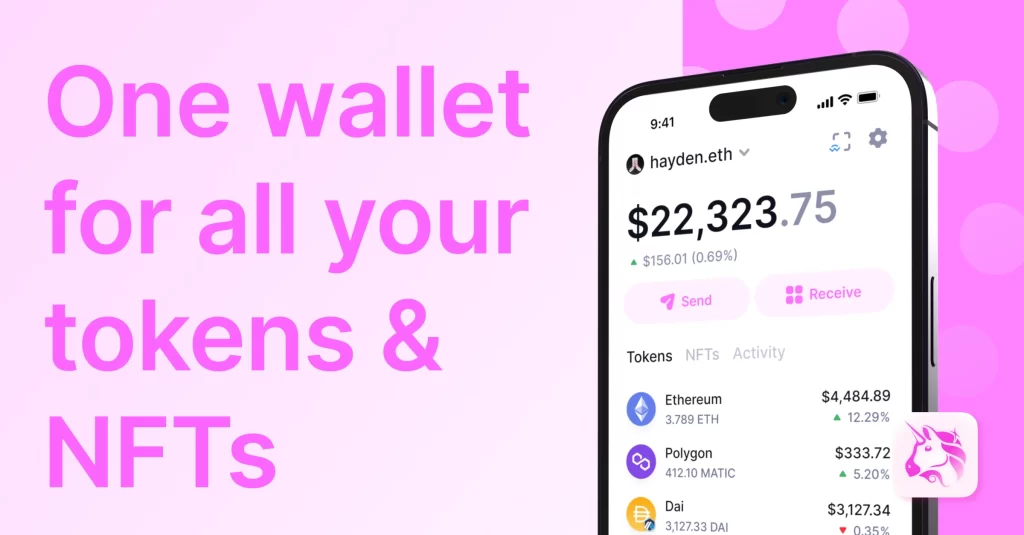

Providing Liquidity on Uniswap: ETH and LP Tokens

Providing liquidity on Uniswap is a way for users to earn fees by supplying pairs of tokens to liquidity pools. This guide explains what liquidity provision is and how liquidity provider (LP) tokens work.

What is Liquidity Provision?

Liquidity provision involves supplying tokens to Uniswap’s liquidity pools, which are essential for enabling trades on the platform.

- Liquidity Pools: These are pools of token pairs locked in smart contracts. They facilitate trading by ensuring there is enough liquidity for token swaps.

- Token Pairs: Liquidity providers must supply an equal value of two tokens to a pool. Common pairs include ETH and a stablecoin like USDC or DAI.

- Automated Market Making: Uniswap uses an Automated Market Maker (AMM) model to determine token prices based on the ratio of tokens in the pool.

- How It Works: When you add liquidity to a pool, you are essentially providing the tokens needed for others to trade.

- Initial Deposit: You need to deposit an equal value of both tokens in the pair. For example, if you provide ETH and USDC, you need to deposit equal values of each token.

- Smart Contract: The tokens are locked in a smart contract, which manages the trades and ensures liquidity.

Earning with Liquidity Provider (LP) Tokens

When you provide liquidity, you earn fees and receive liquidity provider (LP) tokens that represent your share of the pool.

- Earning Fees: Liquidity providers earn a portion of the trading fees generated by the pool.

- Fee Distribution: Every trade on Uniswap incurs a 0.3% fee, which is distributed proportionally among all liquidity providers in the pool.

- Passive Income: By providing liquidity, you earn passive income from the trading fees, which are automatically added to your share in the pool.

- Liquidity Provider (LP) Tokens: When you add liquidity, you receive LP tokens that represent your stake in the pool.

- Ownership Proof: LP tokens act as a receipt, proving your ownership of a portion of the liquidity pool.

- Redeeming LP Tokens: You can redeem your LP tokens at any time to withdraw your initial deposit plus any earned fees.

- Impermanent Loss: Be aware of impermanent loss, which occurs when the value of your deposited tokens changes relative to each other. This can affect your earnings when you withdraw your liquidity.

- Reinvestment Options: You can reinvest your earnings by adding more liquidity or use LP tokens in other decentralized finance (DeFi) applications.

- Staking LP Tokens: Some platforms allow you to stake your LP tokens to earn additional rewards.

- Yield Farming: Participate in yield farming by using LP tokens to earn more tokens through various DeFi protocols.

Alternatives to ETH: Using Wrapped Ether (WETH)

Wrapped Ether (WETH) is an important alternative to ETH that offers greater compatibility within the Ethereum ecosystem. Understanding WETH and how to use it in place of ETH can enhance your interactions with decentralized applications (dApps) like Uniswap.

What is Wrapped Ether (WETH)?

Wrapped Ether (WETH) is a token that represents Ether (ETH) on the Ethereum blockchain, designed to comply with the ERC-20 standard.

- ERC-20 Standard: Unlike ETH, WETH adheres to the ERC-20 token standard, which is the most common standard for tokens on the Ethereum network.

- Interoperability: WETH can be used in any dApp that supports ERC-20 tokens, providing greater interoperability across the Ethereum ecosystem.

- Tokenization: WETH is created by depositing ETH into a smart contract that issues an equivalent amount of WETH. This process is reversible, allowing WETH to be converted back to ETH.

- Functionality: WETH retains the same value as ETH and can be used in various DeFi applications that require ERC-20 tokens.

- 1:1 Peg: The value of WETH is pegged 1:1 to ETH, ensuring that 1 WETH is always equivalent to 1 ETH.

- Liquidity: WETH provides a way to use ETH in liquidity pools and other DeFi protocols that require ERC-20 tokens.

Using WETH in Place of ETH

Using WETH instead of ETH offers several advantages, particularly when interacting with DeFi platforms like Uniswap.

- Swapping ETH for WETH: To use WETH, you first need to swap your ETH for WETH.

- Conversion Process: You can wrap your ETH by sending it to a smart contract that returns an equivalent amount of WETH. This can be done through various dApps or directly on platforms like Uniswap.

- Unwrapping: Similarly, you can convert WETH back to ETH by sending it to the smart contract, which will return an equivalent amount of ETH.

- Advantages of WETH: Using WETH provides greater flexibility and access within the DeFi ecosystem.

- Compatibility: Many DeFi applications, including Uniswap, require tokens to be ERC-20 compliant. Using WETH ensures compatibility and seamless interaction with these platforms.

- Liquidity Pools: Providing liquidity on Uniswap often involves depositing ERC-20 tokens. By using WETH, you can participate in more liquidity pools and earn fees from trades.

- Steps to Use WETH on Uniswap:

- Wrapping ETH: First, convert your ETH to WETH using Uniswap or another dApp. This involves a simple transaction where you deposit ETH and receive WETH in return.

- Trading with WETH: Once you have WETH, you can use it to trade or provide liquidity on Uniswap. The process is the same as with any other ERC-20 token.

- Gas Fees: Transactions involving WETH still require gas fees paid in ETH. Ensure you have enough ETH in your wallet to cover these fees.

- Managing WETH:

- Wallets: Most Ethereum-compatible wallets support WETH. Ensure your wallet can handle ERC-20 tokens to store and manage WETH.

- Monitoring Prices: While WETH is pegged to ETH, always monitor the conversion rates and network fees to optimize your transactions.

Managing Gas Fees: Tips for Efficient Use of Uniswap

Gas fees are an essential consideration for anyone using Uniswap, as they can significantly impact the cost of transactions. Efficiently managing these fees can help you save money and make the most of your trading activities on the platform.

Monitoring Gas Prices

Monitoring gas prices is crucial for optimizing the timing and cost of your transactions.

- Gas Price Fluctuations: Gas prices on the Ethereum network can vary widely depending on network congestion and demand.

- Peak and Off-Peak Times: Gas prices tend to be higher during peak times when network activity is high. Conversely, they are usually lower during off-peak times.

- Transaction Timing: Planning your transactions during periods of lower network activity can help reduce gas costs.

- Gas Price Tracking Tools: There are several tools available that help you monitor real-time gas prices and predict trends.

- Etherscan Gas Tracker: This tool provides current gas prices and estimates transaction costs based on network activity.

- Gas Now: An online service that offers real-time gas price updates and historical data to help you choose the best time for your transactions.

- Ethereum Gas Station: A comprehensive tool that provides gas price recommendations and estimated transaction times based on current network conditions.

Tools for Gas Fee Optimization

Utilizing gas fee optimization tools can further enhance your ability to manage costs effectively.

- Gas Fee Estimation: Many wallets and dApps provide built-in gas fee estimation tools that suggest optimal gas prices for different transaction speeds (slow, average, fast).

- MetaMask: This popular wallet extension includes gas fee recommendations and allows users to customize gas prices.

- Trust Wallet: A mobile wallet that offers gas fee estimation and allows adjustments based on current network conditions.

- Transaction Batching: Batching multiple transactions into a single batch can help save on gas fees.

- Efficiency: By combining several smaller transactions into one larger transaction, you can reduce the overall gas cost.

- Smart Contracts: Some advanced users write custom smart contracts to batch their transactions and minimize fees.

- Layer 2 Solutions: Exploring Layer 2 scaling solutions can significantly reduce gas fees for frequent traders.

- Optimistic Rollups: A scaling solution that reduces the load on the Ethereum mainnet by processing transactions off-chain and settling them on-chain.

- Polygon (formerly Matic): A popular Layer 2 solution that offers lower transaction fees and faster processing times compared to the Ethereum mainnet.

- Gas Fee Strategies: Adopting different strategies can help manage and optimize gas fees.

- Set Gas Price Alerts: Use tools like Gas Now or Etherscan to set alerts for specific gas price thresholds, ensuring you only transact when fees are low.

- Adjust Transaction Speed: Depending on the urgency of your transaction, you can choose to pay lower gas fees for slower confirmation times or higher fees for faster processing.