Yes, Uniswap is available in the US, but users must comply with federal and state regulations regarding cryptocurrency trading.

Understanding Uniswap’s Availability in the US

Uniswap, a decentralized exchange (DEX) built on the Ethereum blockchain, allows users to swap various cryptocurrencies without relying on a central authority. Its availability in the US is subject to various regional restrictions and legal considerations.

Regional Restrictions

- State-by-State Variations: While Uniswap is broadly accessible across the US, some states have specific regulations that may affect its use. States like New York, for instance, have stringent cryptocurrency regulations.

- Access Limitations: Certain features of Uniswap might be limited or restricted in specific regions within the US. Users need to stay informed about their state’s stance on decentralized exchanges.

- VPN Usage: Some users opt for Virtual Private Networks (VPNs) to circumvent regional restrictions, but this can come with its own set of legal and security risks.

Legal Considerations

- Regulatory Compliance: US users must adhere to federal and state regulations regarding cryptocurrency trading. The SEC and CFTC oversee different aspects of cryptocurrency transactions and trading platforms.

- Know Your Customer (KYC) and Anti-Money Laundering (AML): Even though Uniswap itself does not enforce KYC/AML policies, US users are still subject to these regulations when converting crypto to fiat on centralized platforms.

- Tax Obligations: US residents are required to report their cryptocurrency transactions to the IRS. Failure to do so can result in penalties and fines. It’s essential to maintain accurate records of all transactions conducted on Uniswap.

How to Access Uniswap in the US

Accessing Uniswap in the US is straightforward for most users, but understanding the steps and tools involved can enhance your experience and ensure compliance with regulations.

Step-by-Step Guide

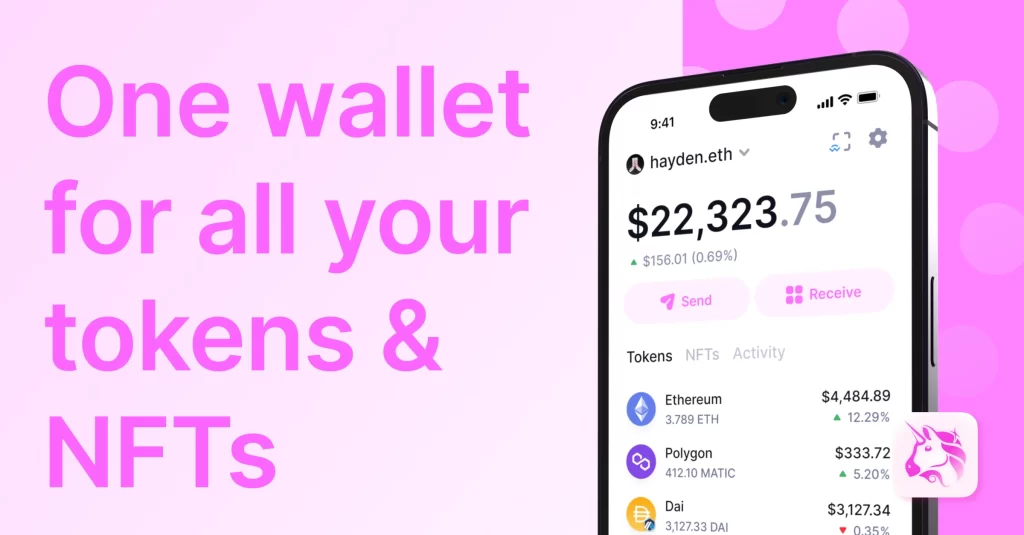

- Create a Cryptocurrency Wallet: Start by creating a cryptocurrency wallet compatible with Uniswap, such as MetaMask, Trust Wallet, or Coinbase Wallet. Ensure your wallet is secure and backed up.

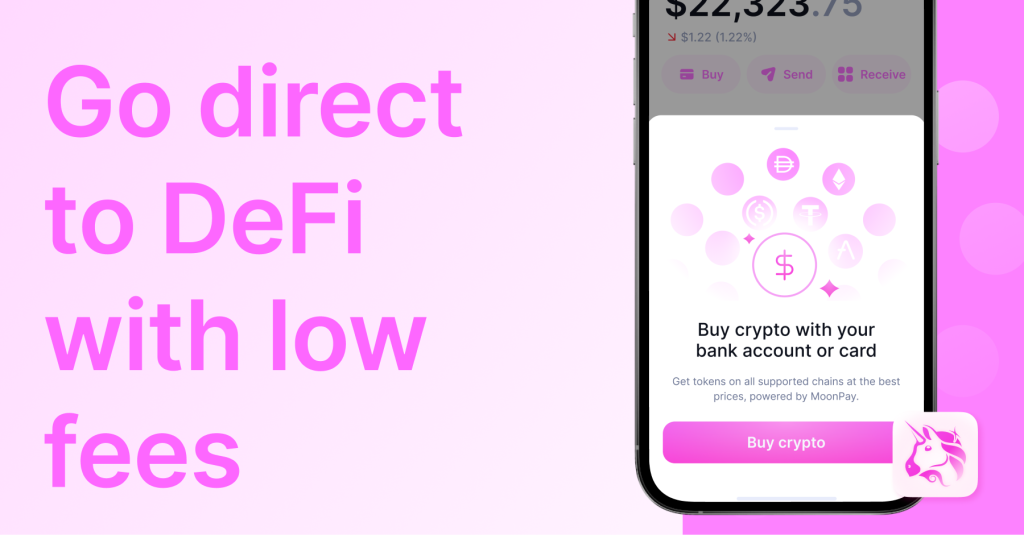

- Fund Your Wallet: Purchase Ethereum (ETH) or other supported tokens from a cryptocurrency exchange and transfer them to your wallet. This will be used to pay for transactions on Uniswap.

- Connect to Uniswap: Visit the Uniswap website and connect your wallet by following the prompts. Ensure you are on the official Uniswap website to avoid phishing scams.

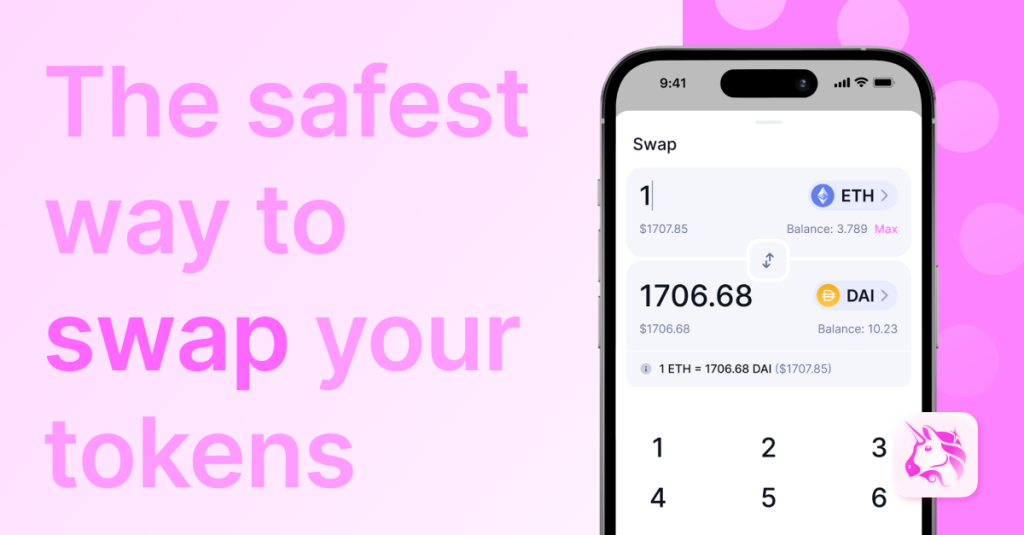

- Start Trading: Once your wallet is connected, you can start trading tokens on Uniswap. Enter the amount of the token you want to trade, select the token you want in return, and confirm the transaction.

Tools and VPNs

- Cryptocurrency Wallets: Essential tools for interacting with Uniswap. Popular options include:

- MetaMask

- Trust Wallet

- Coinbase Wallet

- Portfolio Trackers: To keep track of your trades and holdings, consider using portfolio tracking apps like CoinTracker or Blockfolio.

- VPNs for Privacy and Access: While not always necessary, using a VPN can provide additional privacy and help access Uniswap if facing regional restrictions. Popular VPN services include:

- NordVPN

- ExpressVPN

- CyberGhost

- Security Tools: Ensure your trading is secure by using hardware wallets like Ledger or Trezor, and enabling two-factor authentication (2FA) on all related accounts.

Legal Regulations Surrounding Uniswap in the US

Navigating the legal landscape for using Uniswap in the US is crucial for ensuring compliance and avoiding potential legal issues. Understanding the compliance requirements and the regulatory bodies involved is essential for US-based users.

Compliance Requirements

- Know Your Customer (KYC) and Anti-Money Laundering (AML): While Uniswap, as a decentralized exchange, does not enforce KYC/AML policies directly, US users are still subject to these regulations when converting cryptocurrency to fiat on centralized exchanges. Ensuring compliance with KYC/AML regulations is necessary to avoid legal complications.

- Tax Reporting: The Internal Revenue Service (IRS) requires US residents to report all cryptocurrency transactions. This includes trades, conversions, and any gains or losses incurred. Maintaining detailed records of all transactions on Uniswap is essential for accurate tax reporting.

- Securities Compliance: Some tokens traded on Uniswap may be classified as securities by the Securities and Exchange Commission (SEC). US users should be aware of the securities regulations that may apply to their trades and ensure they are not engaging in illegal securities trading.

Regulatory Bodies

- Securities and Exchange Commission (SEC): The SEC oversees securities regulation in the US. It has taken a keen interest in cryptocurrencies, particularly those that may qualify as securities. Compliance with SEC regulations is essential to avoid penalties.

- Commodity Futures Trading Commission (CFTC): The CFTC regulates the trading of commodity futures and options in the US. Certain aspects of cryptocurrency trading, especially derivatives, fall under its jurisdiction.

- Financial Crimes Enforcement Network (FinCEN): FinCEN is responsible for enforcing AML regulations and monitoring financial transactions to prevent money laundering and terrorist financing. US-based users must ensure their activities on Uniswap comply with FinCEN’s regulations.

- Internal Revenue Service (IRS): The IRS governs tax regulations and requirements for cryptocurrency transactions. US users must accurately report their cryptocurrency activities to comply with IRS guidelines.

Comparing Uniswap with Other Decentralized Exchanges in the US

Decentralized exchanges (DEXs) have become increasingly popular among cryptocurrency traders for their security and privacy features. This section compares Uniswap with other DEXs available in the US, highlighting the pros and cons of each, and focusing on the user experience.

Pros and Cons

- Uniswap

- Pros:

- Liquidity: One of the largest DEXs, providing substantial liquidity for a wide range of tokens.

- User-Friendly Interface: Simple and intuitive interface, making it accessible for beginners.

- Wide Token Selection: Supports a vast array of ERC-20 tokens.

- Cons:

- Gas Fees: High Ethereum gas fees can make small trades expensive.

- No Native KYC/AML: Lack of KYC/AML may raise compliance concerns for US users when converting to fiat.

- Pros:

- SushiSwap

- Pros:

- Rewards: Offers staking rewards and additional incentives for liquidity providers.

- Community Governance: Decentralized governance, allowing users to have a say in platform decisions.

- Cons:

- Security Concerns: Experienced security issues in the past, although improvements have been made.

- Complexity: More features and options can be overwhelming for new users.

- Pros:

- Curve Finance

- Pros:

- Low Slippage: Designed for stablecoin trading, offering very low slippage.

- Efficiency: Optimized for stablecoin and pegged asset trades, ensuring minimal price impact.

- Cons:

- Limited Tokens: Primarily focused on stablecoins, limiting the range of available tokens.

- Complex Interface: Less intuitive for beginners compared to Uniswap.

- Pros:

- Balancer

- Pros:

- Flexible Pools: Allows users to create and manage liquidity pools with custom token ratios.

- Yield Opportunities: Multiple opportunities for yield farming and earning fees.

- Cons:

- Complexity: Advanced features and options can be confusing for new users.

- Gas Fees: Similar to Uniswap, high Ethereum gas fees can be a drawback.

- Pros:

User Experience

- Uniswap

- Ease of Use: Uniswap is known for its straightforward and easy-to-use interface, making it a preferred choice for beginners and experienced traders alike.

- Transaction Speed: Generally fast transactions, but network congestion on Ethereum can cause delays and increase costs.

- Support and Resources: Extensive documentation and community support are available, aiding users in navigating the platform.

- SushiSwap

- Interface: Slightly more complex than Uniswap, offering additional features like staking and yield farming, which can enhance user engagement.

- Community Interaction: Active community involvement and governance provide a sense of participation and influence over platform development.

- Curve Finance

- Specialization: Excellent for users focusing on stablecoin trading, with a highly optimized platform for such transactions.

- User Interface: Can be daunting for new users due to its specialized nature and technical design.

- Balancer

- Customization: Offers a high degree of customization for advanced users, allowing tailored liquidity pools and strategies.

- Educational Resources: Provides detailed guides and resources to help users understand and maximize the platform’s features.

Security Considerations for US Uniswap Users

Ensuring security while using Uniswap is paramount for protecting investments and personal information. This section delves into the key security measures US Uniswap users should take.

Protecting Investments

- Use Reputable Wallets: Choose reliable and well-reviewed cryptocurrency wallets like MetaMask, Trust Wallet, or hardware wallets such as Ledger and Trezor. These wallets offer robust security features to protect your funds.

- Enable Two-Factor Authentication (2FA): Always enable 2FA on your wallet and any associated accounts. This adds an extra layer of security by requiring a second verification step to access your account.

- Regular Backups: Regularly back up your wallet’s seed phrase and store it in a secure location. This ensures you can recover your funds if your wallet is lost or compromised.

- Beware of Phishing Scams: Always verify that you are visiting the official Uniswap website to avoid phishing scams. Double-check URLs and avoid clicking on suspicious links.

- Monitor Transactions: Regularly review your wallet’s transaction history to spot any unauthorized activity early. Promptly act on any suspicious transactions to mitigate potential losses.

- Use Cold Storage: For long-term holdings, consider using cold storage solutions that are not connected to the internet, reducing the risk of online hacks.

Personal Information Security

- Avoid Sharing Sensitive Information: Never share your wallet’s private keys or seed phrases with anyone. These are crucial for accessing your funds and should be kept confidential.

- Secure Your Devices: Ensure that your devices used for accessing Uniswap are secure. Use updated antivirus software, and enable device encryption and strong passwords.

- Use a VPN: For added privacy, consider using a reputable VPN service to mask your IP address and encrypt your internet connection. This can protect your online activities from potential snoopers.

- Stay Informed: Keep yourself updated on the latest security practices and potential threats in the cryptocurrency space. Follow trusted sources for news and alerts regarding Uniswap and other DEXs.

- Limit Personal Data Exposure: Be cautious about sharing personal information on public forums or social media platforms where you discuss your cryptocurrency activities.

Tax Implications for Using Uniswap in the US

Understanding the tax implications of using Uniswap is essential for US users to ensure compliance with IRS regulations and avoid potential penalties. This section outlines the key reporting requirements and compliance tips.

Reporting Requirements

- Capital Gains and Losses: US residents must report all capital gains and losses from cryptocurrency transactions. Each trade on Uniswap is considered a taxable event, meaning gains or losses must be calculated and reported on your tax return.

- Form 8949: Use IRS Form 8949 to report individual cryptocurrency transactions. This form requires details such as the date of acquisition, date of sale, proceeds, cost basis, and the gain or loss for each transaction.

- Schedule D: Summarize your capital gains and losses on Schedule D of Form 1040. This form consolidates the information from Form 8949 and helps determine your overall tax liability.

- Ordinary Income: Income earned through activities like staking, airdrops, or liquidity mining on Uniswap may be considered ordinary income and must be reported accordingly. This income should be included on your tax return as part of your total income.

- Self-Employment Tax: If you earn income through frequent trading or other activities on Uniswap that qualify as a business, you may need to pay self-employment tax. This tax is reported on Schedule SE of Form 1040.

Compliance Tips

- Keep Detailed Records: Maintain comprehensive records of all your Uniswap transactions, including dates, amounts, transaction IDs, and the value of the assets at the time of each trade. Tools like CoinTracker or Koinly can help automate this process.

- Track Cost Basis: Accurately track the cost basis of your cryptocurrency purchases and sales. The cost basis is the original value of the asset, which is necessary for calculating capital gains or losses.

- Use Tax Software: Consider using cryptocurrency tax software to simplify the process of calculating and reporting your transactions. These tools can help generate the necessary tax forms and ensure accuracy.

- Stay Updated on IRS Guidance: The IRS periodically updates its guidance on cryptocurrency taxation. Stay informed about any changes to ensure your compliance with the latest regulations.

- Consult a Tax Professional: If your cryptocurrency activities are complex or substantial, consider consulting a tax professional with experience in cryptocurrency taxation. They can provide personalized advice and ensure you meet all reporting requirements.

- Understand Tax-Loss Harvesting: Use tax-loss harvesting strategies to offset gains with losses, potentially reducing your overall tax liability. This involves selling assets at a loss to counterbalance gains from other trades.

Future of Uniswap in the US Market

The future of Uniswap in the US market holds significant potential, driven by evolving regulatory landscapes, technological advancements, and growing adoption of decentralized finance (DeFi). This section explores the market prospects and potential changes that may shape Uniswap’s future in the US.

Market Prospects

- Increasing Adoption: As more users become aware of the benefits of decentralized exchanges, Uniswap’s user base in the US is likely to grow. The ease of use, wide range of supported tokens, and the appeal of decentralized trading will continue to attract users.

- Institutional Interest: Institutional investors are showing increasing interest in DeFi platforms like Uniswap. This trend could lead to higher liquidity, more sophisticated trading strategies, and greater market stability.

- Technological Innovations: Continued innovation within the Ethereum ecosystem and the broader DeFi space will enhance Uniswap’s functionality. Upgrades like Ethereum 2.0 and Layer 2 scaling solutions are expected to reduce gas fees and increase transaction throughput, making Uniswap more efficient and accessible.

- Integration with Traditional Finance: The integration of DeFi platforms with traditional financial systems could further bolster Uniswap’s growth. Partnerships with traditional financial institutions and fintech companies may lead to new use cases and increased mainstream adoption.

Potential Changes

- Regulatory Developments: The regulatory environment for cryptocurrencies and DeFi is evolving rapidly. Future regulations could impact Uniswap’s operations in the US, potentially leading to new compliance requirements or restrictions. Staying informed about regulatory changes will be crucial for both Uniswap and its users.

- Enhanced Security Measures: As Uniswap and other DeFi platforms grow, the importance of security will increase. Future updates to Uniswap may focus on enhancing security protocols, implementing advanced fraud detection systems, and improving user education on security best practices.

- Expansion of Services: Uniswap may expand its services beyond token swaps. Potential additions could include lending and borrowing functionalities, insurance products, and other financial services that leverage the decentralized nature of the platform.

- Community Governance: The role of community governance in shaping Uniswap’s future is likely to become more prominent. Users holding Uniswap’s governance token, UNI, will have a say in key decisions, driving the platform’s development in a decentralized manner.

- Cross-Chain Compatibility: The development of cross-chain solutions could enable Uniswap to support trading across multiple blockchain networks, not just Ethereum. This would open up new markets and increase liquidity, making Uniswap even more versatile and attractive to a broader audience.

- User Experience Improvements: Ongoing efforts to improve the user experience will be key to retaining and attracting users. Simplifying the onboarding process, reducing transaction times, and providing better customer support are areas that may see significant enhancements.