Emerging DEXs like SushiSwap and PancakeSwap offer lower fees, better scalability, and additional features, potentially surpassing Uniswap.

Introduction to Decentralized Exchanges

Decentralized exchanges (DEXs) have revolutionized the cryptocurrency trading landscape by offering an alternative to traditional centralized exchanges. Unlike centralized exchanges, DEXs operate without a central authority, enabling peer-to-peer transactions on blockchain networks. This decentralization provides increased security, transparency, and control over users’ funds.

Importance of Decentralized Exchanges

- Security: Since DEXs don’t hold users’ funds, the risk of hacking and theft is significantly reduced. Users maintain control of their private keys, enhancing security.

- Privacy: DEXs often require less personal information compared to centralized exchanges, protecting users’ privacy.

- Censorship Resistance: Operating on blockchain networks, DEXs are less susceptible to government regulations and censorship, allowing for greater freedom in trading.

Growth of DeFi Ecosystem

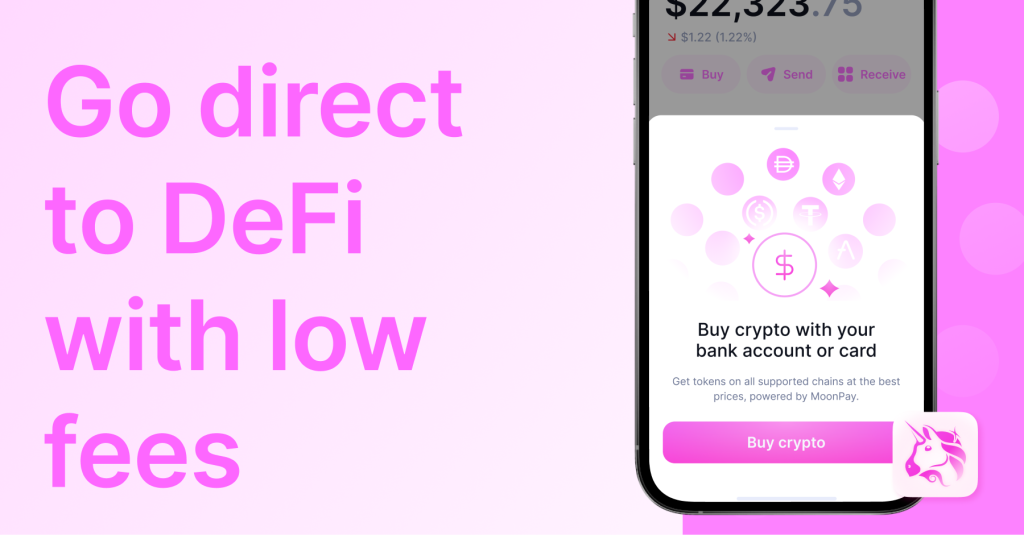

The growth of the decentralized finance (DeFi) ecosystem has been a major catalyst for the popularity of DEXs. DeFi platforms leverage blockchain technology to offer financial services such as lending, borrowing, and trading without intermediaries.

- Increased Adoption: As more users seek decentralized financial services, the adoption of DEXs has surged, driving innovation and competition in the market.

- Interoperability: DeFi projects often interact seamlessly with each other, creating a robust ecosystem where users can move assets freely between different platforms.

- Innovation: Continuous development in DeFi has led to the creation of advanced financial instruments and new ways to generate yield, attracting both retail and institutional investors.

Key Features of Uniswap

Uniswap has become one of the leading decentralized exchanges in the DeFi space due to its innovative features and user-friendly approach. Understanding these key features helps in appreciating why Uniswap is so popular among cryptocurrency traders.

Liquidity Pools

- Automated Market Making (AMM): Uniswap uses an AMM model that relies on liquidity pools instead of traditional order books. This model ensures continuous liquidity for trading pairs by allowing users to trade against the pool.

- Liquidity Providers: Users can contribute their assets to liquidity pools and earn a portion of the trading fees. This incentivizes more users to provide liquidity, enhancing the overall liquidity of the platform.

- Constant Product Formula: Uniswap employs a unique formula (x * y = k) to maintain the balance of assets in the liquidity pools, ensuring that prices adjust dynamically based on supply and demand.

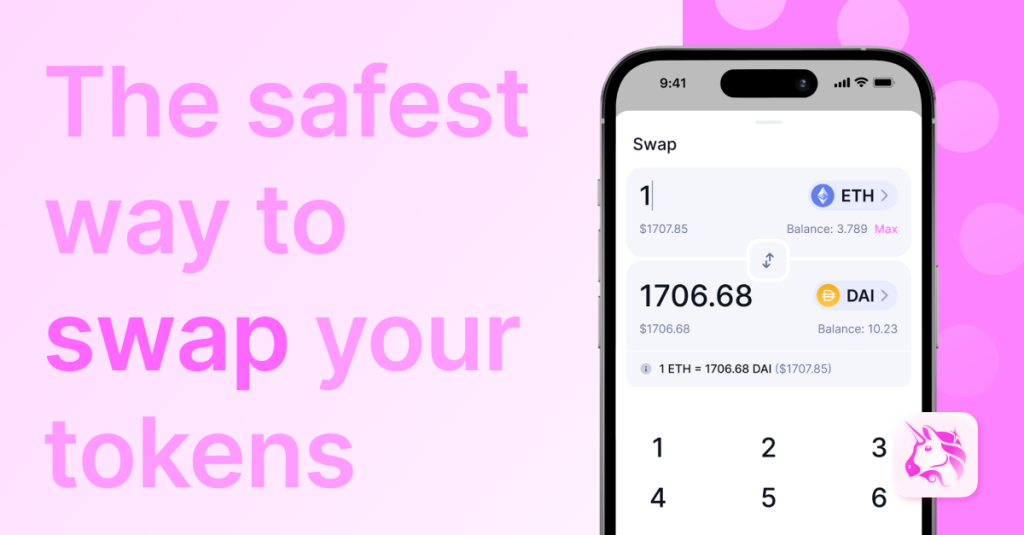

User Interface

- Simplicity: Uniswap’s interface is designed to be intuitive and easy to use, even for beginners. The straightforward design allows users to swap tokens with minimal steps.

- Integration with Wallets: Uniswap seamlessly integrates with popular cryptocurrency wallets like MetaMask, making it easy for users to connect their wallets and start trading.

- Transparency: All transactions on Uniswap are executed on the Ethereum blockchain, providing complete transparency and enabling users to verify transactions independently.

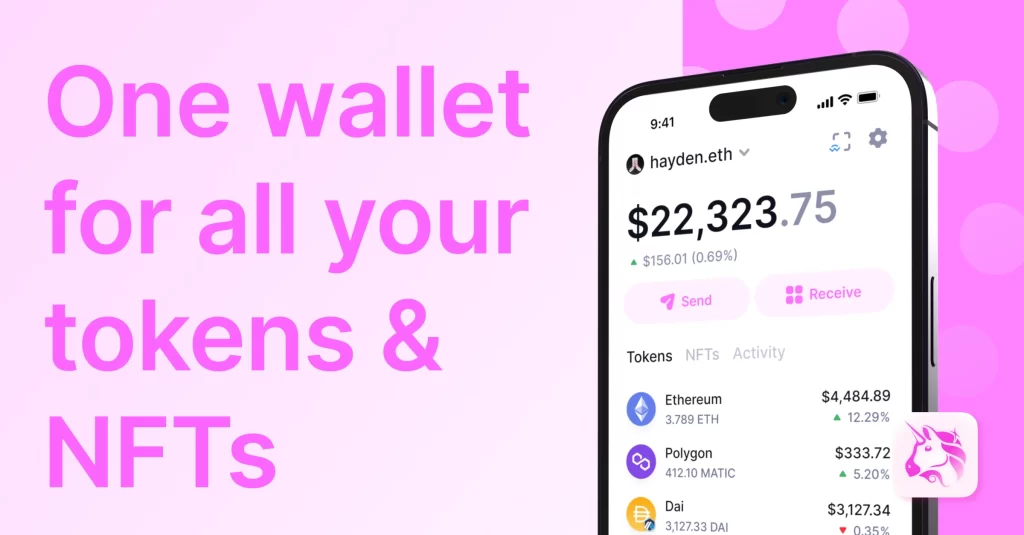

Token Availability

- Wide Range of Tokens: Uniswap supports a vast array of ERC-20 tokens, giving users access to a wide range of assets. This extensive token availability is one of the reasons for its widespread adoption.

- Permissionless Listings: Anyone can list a token on Uniswap without needing approval. This permissionless nature allows new projects to gain visibility and liquidity quickly.

- Community Governance: Uniswap’s governance model allows token holders to propose and vote on changes to the platform, including the addition of new tokens, ensuring that the community has a say in its development.

Limitations of Uniswap

While Uniswap offers numerous advantages, it also has certain limitations that users should be aware of. These limitations can affect the overall user experience and the efficiency of trading on the platform.

High Gas Fees

- Transaction Costs: Uniswap operates on the Ethereum blockchain, where gas fees can become very high during periods of network congestion. These high fees can make trading on Uniswap expensive, particularly for smaller transactions.

- Impact on Traders: High gas fees can deter casual traders and small investors, as the cost of executing trades may outweigh the potential benefits.

- Fee Management: Users must monitor gas prices and sometimes wait for periods of lower congestion to execute their trades cost-effectively.

Scalability Issues

- Network Congestion: As Uniswap grows in popularity, the Ethereum network can become congested, leading to slower transaction times and higher fees. This congestion can hinder the efficiency of trading on the platform.

- Transaction Delays: Users may experience delays in their transactions being processed, which can be particularly problematic during volatile market conditions when timely trades are crucial.

- Layer 2 Solutions: While there are ongoing efforts to implement Layer 2 solutions to alleviate scalability issues, these are still in development and not yet widely adopted.

User Experience Problems

- Complexity for Beginners: Despite Uniswap’s relatively simple interface, the concept of decentralized trading and using wallets like MetaMask can still be daunting for beginners. Understanding liquidity pools and gas fees requires a learning curve.

- Transaction Errors: Users can encounter errors such as failed transactions due to fluctuating gas prices or insufficient funds. These errors can be frustrating and lead to lost time and money.

- Limited Customer Support: As a decentralized platform, Uniswap does not offer traditional customer support. Users must rely on community forums and resources for assistance, which can be insufficient for complex issues.

Emerging Competitors to Uniswap

As the decentralized finance (DeFi) landscape continues to evolve, several new decentralized exchanges (DEXs) are emerging as strong competitors to Uniswap. These platforms offer innovative features and improvements that address some of the limitations found in Uniswap.

New Decentralized Exchanges

- SushiSwap: Originating as a fork of Uniswap, SushiSwap has introduced several unique features and a strong community-driven approach. Its governance model and additional functionalities have attracted a significant user base.

- PancakeSwap: Operating on the Binance Smart Chain (BSC), PancakeSwap offers lower transaction fees and faster transaction times compared to Ethereum-based DEXs. This makes it an attractive alternative for cost-conscious traders.

- Balancer: Balancer allows users to create customizable liquidity pools with multiple tokens and varying weights. This flexibility provides users with more options for liquidity provision and portfolio management.

Innovative Features

- Yield Farming: Many new DEXs incorporate yield farming opportunities, allowing users to earn rewards by staking their tokens in liquidity pools. This additional earning potential has attracted many users to platforms like SushiSwap and PancakeSwap.

- Cross-Chain Compatibility: Some emerging DEXs are focusing on cross-chain compatibility, enabling users to trade assets across different blockchain networks. This interoperability can significantly expand the trading possibilities beyond a single blockchain.

- Enhanced Governance: Improved governance models are being implemented by new DEXs, allowing for more decentralized and community-driven decision-making processes. This ensures that users have a direct say in the development and management of the platform.

- Improved User Interfaces: Competitors are investing in more user-friendly interfaces and educational resources to make decentralized trading more accessible to beginners. Simplified onboarding processes and intuitive designs enhance the overall user experience.

- Lower Fees and Scalability Solutions: Addressing the high gas fees and scalability issues of Ethereum-based DEXs, new exchanges on alternative blockchains like Binance Smart Chain, Polygon, and others offer lower transaction costs and faster processing times.

Comparing Transaction Fees

Transaction fees are a critical consideration for traders using decentralized exchanges (DEXs). Understanding the fee structures and identifying cost-effective trading platforms can help users maximize their profits and reduce costs.

Fee Structures

- Gas Fees on Ethereum: Uniswap operates on the Ethereum blockchain, where transaction fees, known as gas fees, can vary widely based on network congestion. High gas fees during peak times can make trading on Uniswap expensive, particularly for small trades.

- Flat Fees: Some DEXs, such as PancakeSwap on the Binance Smart Chain, use a flat fee structure. This approach provides predictability and can be more economical, especially when compared to the fluctuating gas fees on Ethereum.

- Dynamic Fees: Other platforms implement dynamic fee structures based on the size of the trade or liquidity pool usage. For example, Balancer allows liquidity providers to set custom fees for their pools, which can vary significantly.

- Fee Reductions: Many platforms offer fee reductions or rebates for users who hold and use the platform’s native tokens. SushiSwap, for example, provides fee discounts for users holding xSUSHI tokens.

Cost-Effective Trading Platforms

- PancakeSwap: Operating on the Binance Smart Chain, PancakeSwap offers significantly lower transaction fees compared to Ethereum-based DEXs. This makes it an attractive option for traders looking to minimize costs.

- SushiSwap: While SushiSwap also operates on the Ethereum blockchain, it offers additional yield farming opportunities and staking rewards, which can help offset the high gas fees.

- Polygon (Matic) DEXs: Decentralized exchanges built on the Polygon network, such as QuickSwap, benefit from Polygon’s lower transaction fees and faster confirmation times. This provides a more cost-effective and efficient trading experience.

- 1inch: As a DEX aggregator, 1inch searches across multiple DEXs to find the best prices and lowest fees for each trade. This can help users save on transaction costs by optimizing their trades across different platforms.

- Balancer: With its customizable liquidity pools and flexible fee structures, Balancer allows users to find pools with lower fees that match their trading needs. This flexibility can result in more cost-effective trading.

User Experience and Interface Design

The user experience and interface design of decentralized exchanges (DEXs) play a crucial role in attracting and retaining users. A well-designed interface can significantly enhance the ease of use and accessibility of a platform, making decentralized trading more approachable for both beginners and experienced traders.

Ease of Use

- Intuitive Navigation: An intuitive and straightforward navigation system is essential for users to quickly find the features they need. Platforms like Uniswap and PancakeSwap have simplified interfaces that allow users to perform swaps with just a few clicks.

- Clear Instructions: Providing clear and concise instructions for key actions, such as connecting a wallet, adding liquidity, or swapping tokens, helps reduce the learning curve for new users. Tooltips and guided tutorials are beneficial.

- Simplified Processes: Reducing the number of steps required to complete a transaction can enhance the user experience. For example, Uniswap’s minimalist design allows users to connect their wallet and start trading without needing to create an account or go through a lengthy setup process.

- Visual Feedback: Real-time visual feedback, such as loading indicators and transaction confirmations, reassures users that their actions are being processed. This reduces uncertainty and improves user confidence in the platform.

Accessibility

- Mobile Compatibility: Ensuring that the DEX is fully functional on mobile devices is crucial for accessibility. Mobile-friendly designs and dedicated apps, like those offered by PancakeSwap, enable users to trade on the go.

- Language Support: Offering multiple language options can make the platform more accessible to a global audience. Providing localized content helps users who are not fluent in English to navigate and use the platform effectively.

- Wallet Integration: Seamless integration with popular cryptocurrency wallets like MetaMask, Trust Wallet, and WalletConnect is essential for accessibility. This allows users to connect their wallets easily and securely from various devices.

- Inclusive Design: Designing with accessibility in mind includes considering users with disabilities. Features such as screen reader compatibility, high-contrast modes, and keyboard navigability ensure that the platform is usable by everyone.

- Community Support: A strong community support system, including forums, FAQs, and customer service, can greatly enhance accessibility. Users can find answers to their questions and get help when needed, making the platform more user-friendly.

Security and Reliability

Security and reliability are paramount in the world of decentralized exchanges (DEXs). Ensuring that users’ funds and data are safe while maintaining a stable and dependable platform is essential for building trust and long-term success.

Safety Measures

- Smart Contract Audits: Regular audits of smart contracts by reputable third-party firms help identify and fix vulnerabilities before they can be exploited. Platforms like Uniswap and SushiSwap undergo extensive audits to ensure the integrity of their code.

- Bug Bounties: Implementing bug bounty programs incentivizes the community to find and report security flaws. This proactive approach helps maintain a high level of security by leveraging the collective expertise of developers and security researchers.

- Decentralized Governance: Empowering the community through decentralized governance can enhance security. By allowing token holders to vote on proposals and changes, DEXs can ensure that no single entity has control over critical aspects of the platform.

- Multi-Signature Wallets: Utilizing multi-signature wallets for the management of treasury funds and administrative actions adds an extra layer of security. Multiple approvals are required for transactions, reducing the risk of unauthorized access.

- Insurance Funds: Some DEXs establish insurance funds to cover potential losses due to hacks or bugs. This provides an additional safety net for users, increasing confidence in the platform’s security measures.

Platform Stability

- Robust Infrastructure: Ensuring that the platform is built on a robust and scalable infrastructure is crucial for stability. This includes using reliable cloud services, redundant systems, and load balancing to handle high traffic and prevent downtime.

- Regular Updates: Continuously updating the platform with the latest security patches and performance improvements helps maintain stability. Keeping the software up-to-date ensures that known vulnerabilities are addressed promptly.

- Network Congestion Management: Implementing solutions to manage network congestion, such as Layer 2 scaling solutions or sidechains, can improve the platform’s stability and reduce transaction delays. Platforms like PancakeSwap on Binance Smart Chain benefit from lower congestion compared to Ethereum-based DEXs.

- Disaster Recovery Plans: Having comprehensive disaster recovery plans in place ensures that the platform can quickly recover from unexpected events, such as cyber-attacks or technical failures. This includes regular backups and failover mechanisms.

- Community and Developer Support: A strong community and active developer support contribute to the platform’s stability. Ongoing contributions from the community help identify and fix issues quickly, while active development ensures continuous improvement and innovation.

Future Trends in Decentralized Exchanges

The decentralized finance (DeFi) space is rapidly evolving, and decentralized exchanges (DEXs) are at the forefront of this innovation. Understanding the future trends and upcoming technologies can help users and developers anticipate the next wave of advancements in this dynamic ecosystem.

Upcoming Technologies

- Layer 2 Scaling Solutions: Technologies such as Optimistic Rollups and zk-Rollups are gaining traction to address the scalability issues of Ethereum. These Layer 2 solutions can significantly reduce transaction costs and increase throughput, making DEXs more efficient and accessible.

- Cross-Chain Interoperability: Protocols enabling cross-chain interoperability, such as Polkadot and Cosmos, allow assets and data to move seamlessly between different blockchains. This will enable DEXs to offer a wider range of trading pairs and access to liquidity across multiple networks.

- Decentralized Identity Solutions: Implementing decentralized identity solutions can enhance security and compliance without compromising user privacy. Projects like SelfKey and Civic are working on blockchain-based identity verification systems that can be integrated into DEXs.

- AI and Machine Learning: Incorporating AI and machine learning can improve the user experience and platform efficiency. For example, AI-driven trading bots can offer advanced trading strategies, while machine learning can enhance fraud detection and risk management.

Innovations in DeFi

- Automated Market Making (AMM) Enhancements: Innovations in AMM algorithms are leading to more efficient and flexible liquidity provision. New models such as concentrated liquidity (as seen in Uniswap V3) allow liquidity providers to allocate their assets more precisely, optimizing returns.

- Synthetic Assets and Derivatives: The development of synthetic assets and derivatives on DEXs is expanding the range of financial products available to users. Platforms like Synthetix allow users to trade assets that mirror the value of real-world assets, increasing market opportunities.

- Decentralized Insurance: Decentralized insurance protocols are emerging to protect users against various risks, including smart contract failures and hacks. Projects like Nexus Mutual and Cover Protocol provide insurance coverage, increasing user confidence in DeFi platforms.

- Social Trading and Community Governance: The integration of social trading features and enhanced community governance models allows users to follow successful traders and participate more actively in platform decisions. This fosters a more engaged and informed user base.

- Tokenized Real-World Assets: The tokenization of real-world assets, such as real estate and commodities, is bringing traditional finance into the DeFi ecosystem. This trend allows users to trade and invest in a broader range of asset classes directly on DEXs.

- Privacy-Preserving Technologies: Enhancing privacy on DEXs through technologies like zero-knowledge proofs (ZKPs) and confidential transactions can protect user data and transaction details. Projects like Tornado Cash and Aztec Network are pioneering privacy solutions in DeFi.